Morningstar, a firm that evaluates and rates mutual fund performance, published an article on its Web site

Question:

Morningstar, a firm that evaluates and rates mutual fund performance, published an article on its Web site discussing a company's book value per share (shareholder's equity/number of shares outstanding) versus its market price per share. Morningstar claims that the price-to-book ratio (market price per share/book value per share) is a measure of the difference between the value the stock market attaches to a firm and the value GAAP attaches to the firm.

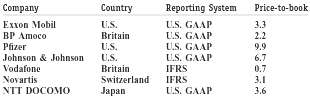

Business Week, in its 2003 Global 100 Scoreboard, tracked the price-to-book ratio for the top companies in the world. Selected ratios are as follows.

REQUIRED:

Discuss why book value and market value are not the same. What factors would increase or decrease the price-to-book ratio? How could the nature of the business or the health of the economy affect theratio?

Step by Step Answer: