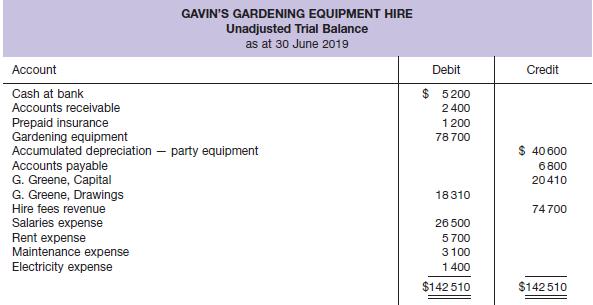

Gavins Gardening Equipment Hires unadjusted trial balance of the business appears as shown below. Ignore GST. Additional

Question:

Gavin’s Gardening Equipment Hire’s unadjusted trial balance of the business appears as shown below. Ignore GST.

Additional information 1. Expired insurance amounts to $750.

2. June electricity costs of $330 have not been paid or recorded. No tax invoice has been received.

3. Depreciation on the gardening equipment is $16 250.

4. Hire fees of $1320 were received in advance and were not considered to be revenue at balance date.

5. The Rent Expense account contains $1440 paid for July 2019 rent.

6. A hire fee of $380 received in cash was recorded by debiting Accounts Receivable.

7. Salaries earned amounting to $530 will be paid in July and have not been recorded.

Required

(a) Set up T accounts for the accounts listed in the trial balance.

i. Enter the account balances from the trial balance into the T accounts.

ii. Post the adjusting information directly to the T accounts.

(b) Prepare an adjusted trial balance.

(c) Prepare an income statement and a statement of changes in equity for the year ended 30 June 2019.

(d) Prepare a balance sheet as at 30 June 2019.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie