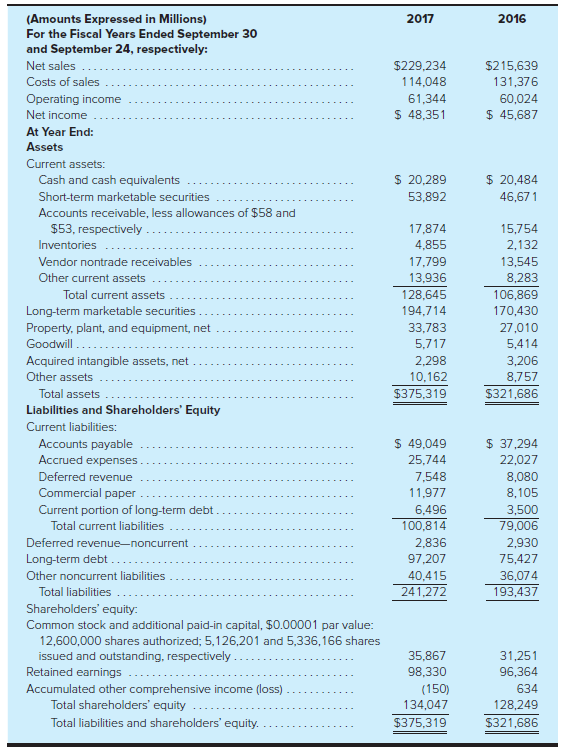

The following summarized data (amounts in millions) are taken from the September 30, 2017, and September 24,

Question:

The following summarized data (amounts in millions) are taken from the September 30, 2017, and September 24, 2016, comparative financial statements of Apple Inc., a company that designs, manufactures, and markets mobile communication and media devices and personal computers; sells a variety of related software, services, accessories, networking solutions, and offers third-party digital content and applications:

At September 26, 2015, total assets were $290,345 and total shareholders? equity was $119,355.

Required:

a. Calculate Apple Inc.?s working capital, current ratio, and acid-test ratio at September 30, 2017, and September 24, 2016. Round your ratio answers to two decimal places.

b. Calculate Apple?s ROE for the years ended September 30, 2017, and September 24, 2016. Round your percentage answers to one decimal place.

c. Calculate Apple?s ROI, showing margin and turnover, for the years ended September 30, 2017, and September 24, 2016. Round your turnover calculations to two decimal places. Round your margin and ROI percentages to one decimal place.

d. Evaluate the company?s overall liquidity and profitability.

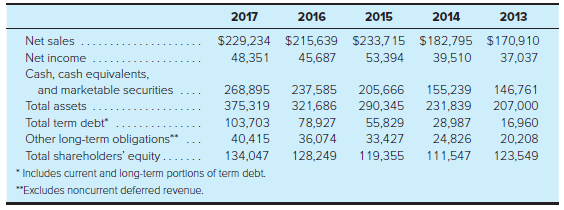

The following historical data were derived from Apple Inc.?s consolidated financial statements (in millions):Note: Past data are not necessarily indicative of the results of future operations.

e. Calculate Apple Inc.?s total liabilities for each year presented above.

f. Are the trends expressed in these data generally consistent with each other?

g. In your opinion, which of these trends would be most meaningful to a potential investor in common stock of Apple Inc.? Which trend would be least meaningful?

h. What other data (trend or otherwise) would you like to have access to before making an investment in Apple Inc.?

1. It means that almost everything is relative, so comparison of an individual firm?s ratio results to the industry trends is important when making judgments about performance.

2. It means that the economic outcome (the amount of return) is related to the input (the investment) utilized to produce the return.

3. It means that investors and others can evaluate the economic performance of a firm, and make comparisons between firms, by using this ratio.

4. It means that a better understanding of ROI is achieved by knowing about the profitability from sales (margin) and the efficiency with which assets have been used (turnover) to generate sales.

5. It means that the focus is changed from return on total assets to return on the portion of total assets (sometimes referred to as capital) provided by the stockholders of the firm.

6. It means that the firm has enough cash, or is likely to soon collect enough cash, to pay its liabilities that are now, or soon will be, due for payment.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele