Candice-Marie James and Flossie Graham obtained a one-year lease on a small shop which cost them 15,000

Question:

Candice-Marie James and Flossie Graham obtained a one-year lease on a small shop which cost them £15,000 for the year 2010, and in addition agreed to pay rent of £4,000 per year payable one year in advance. Candyfl oss started trading on 1 January 2010 as a fl orist, and Candice and Flossie bought a second-hand, white delivery van for which they paid £14,500. The business was fi nanced by Candice and Flossie each providing £9,000 from their savings, and receipt of an interest-free loan from Candice’s uncle of £3,000. Candice and Flossie thought they were doing OK over their fi rst six months but they weren’t sure how to measure this. They decided to try and see how they were doing fi nancially and looked at the transactions for the fi rst six months:

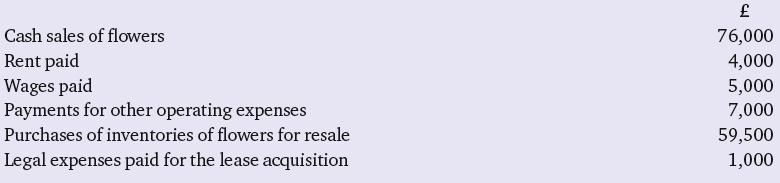

Cash transactions:

In addition, at 30 June 2010:

The business owed a further £4,000 for the purchase of fl owers and £1,000 for other operating expenses.

Customers had purchased fl owers on credit and the sum still owed amounted to £8,000.

One customer was apparently in fi nancial diffi culties and it was likely that the £1,500 owed would not be paid.

Inventories of fl owers at 30 June 2010 valued at cost were £9,500.

They estimated that the van would last four years, at which time they expected to sell it for £2,500, and that depreciation would be spread evenly over that period.

(i) Prepare a statement of cash fl ows for Candyfl oss for the fi rst six months of the year 2010 using the direct method.

(ii) Prepare an income statement for Candyfl oss for the fi rst six months of the year 2010, on an accruals basis.

(iii) Why is the profi t diff erent from the cash fl ow?

(iv) Which statement gives the best indication of the fi rst six months’ performance of Candyfloss?

Step by Step Answer: