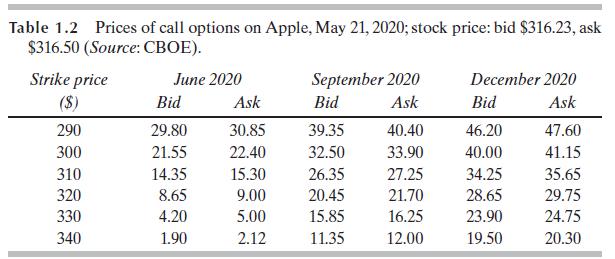

On May 21, 2020, as indicated in Table 1.2, the spot ask price of Apple stock is

Question:

On May 21, 2020, as indicated in Table 1.2, the spot ask price of Apple stock is $316.50 and the ask price of a call option with a strike price of $320 and a maturity date of September is $21.70. A trader is considering two alternatives: buy 100 shares of the stock and buy 100 September call options. For each alternative, what is

(a) the upfront cost,

(b) the total gain if the stock price in September is $400, and

(c) the total loss if the stock price in September is $300. Assume that the option is not exercised before September and positions are unwound at option maturity.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: