The following is the monthly payroll for the last 3 months of the year for Dell?s Sporting

Question:

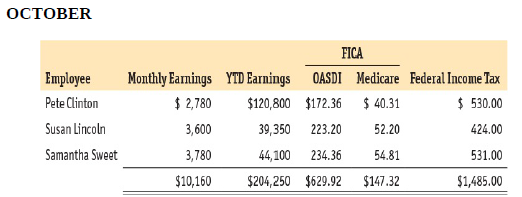

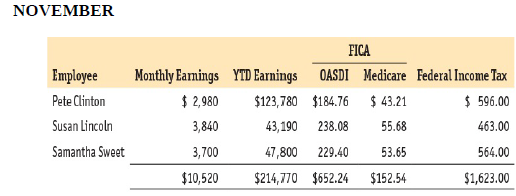

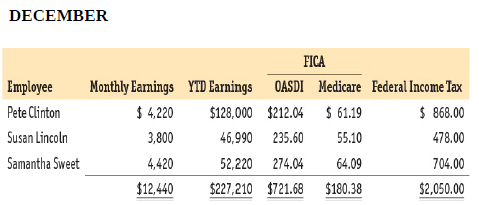

The following is the monthly payroll for the last 3 months of the year for Dell?s Sporting Goods Shop, 2 Boat Road, Lynn, MA 01945. The shop is a sole proprietorship owned and operated by Bill Dell. The EIN for Dell?s Sporting Goods Shop is 28-9311893. The employees at Dell?s are paid once each month on the last day of the month. Pete Clinton is the only employee who has contributed the maximum into Social Security. None of the other employees will reach the Social Security wage base limit by the end of the year. Assume the rate for Social Security to be 6.2% with a wage base maximum of $127,200 and the rate for Medicare to be 1.45% on all earnings. Dell?s is classified as a monthly depositor for Form 941 payroll tax deposit purposes.

Your tasks are to do the following:

1. Compute the December OASDI tax for Pete Clinton.

2. Journalize the entries to record the employer?s payroll tax expense for each period in the general journal. SUTA rate: 5.7%; FUTA rate: 0.6%.

3. Journalize the payment of each tax liability in the general journal.

4. Complete Form 941 for the fourth quarter of the current year.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps