The U.S. Office of Management and Budget has estimated that the tax-exempt status of fringe benefits such

Question:

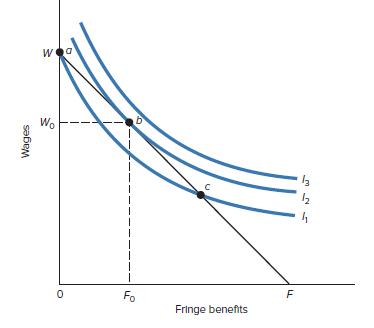

The U.S. Office of Management and Budget has estimated that the tax-exempt status of fringe benefits such as pensions and group insurance reduced tax revenue to the Treasury by about $460 billion in 2018. Some economists have suggested that the federal government recover this tax revenue by taxing fringe benefits as ordinary income. Use Figure 7.5 to explain how this proposal would affect

(a) the slope of the indifference curves and

(b) the slope of the isoprofit curve. What would be the likely effect on the optimal level of fringe benefits?

Data from Figure 7.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Contemporary Labor Economics

ISBN: 9781260570625

12th Edition

Authors: Campbell McConnell, Stanley Brue, David Macpherson

Question Posted: