Calculate the geometric average return for S&P 500 large-cap stocks for a five-year period using the numbers

Question:

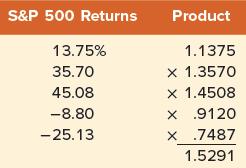

Calculate the geometric average return for S&P 500 large-cap stocks for a five-year period using the numbers given here.

First, convert percentages to decimal returns, add 1, and then calculate their product:

Notice that the number 1.5291 is what our investment is worth after five years if we started with a $1 investment. The geometric average return is then calculated as:![]()

Thus, the geometric average return is about 8.87 percent in this example. Here is a tip: If you are using a financial calculator, you can put −$1 in as the present value, $1.5291 as the future value, and 5 as the number of periods. Then solve for the unknown rate. You should get the same answer we did.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe