Suppose a stock begins the year with a price of $25 per share and ends with a

Question:

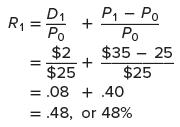

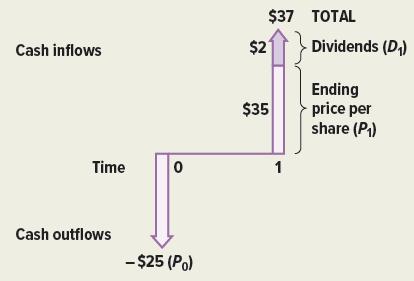

Suppose a stock begins the year with a price of $25 per share and ends with a price of $35 per share. During the year, it paid a $2 dividend per share. What are its dividend yield, capital gains yield, and total return for the year? We can imagine the cash flows in Figure 10.3.

Thus, the stock’s dividend yield, capital gains yield, and total return are 8 percent, 40 percent, and 48 percent, respectively.

Suppose you had $5,000 invested. The total dollar return you would have received on an investment in the stock is $5,000 × .48 = $2,400. If you know the total dollar return on the stock, you do not need to know how many shares you would have had to purchase to figure out how much money you would have made on the $5,000 investment; you use the total dollar return.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe