Consider the following options portfolio: You write a November 2019 expiration call option on Microsoft with exercise

Question:

Consider the following options portfolio: You write a November 2019 expiration call option on Microsoft with exercise price $140. You also write a November expiration Microsoft put option with exercise price $145.

a. Graph the payoff of this portfolio at option expiration as a function of the stock price at that time.

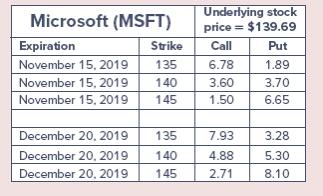

b. What will be the profit/loss on this position if Microsoft is selling at $145 on the option expiration date? What if it is selling at $150? Use option prices from Figure 15.1 to answer this question.

Figure 15.1

c. At what two stock prices will you just break even on your investment?

d. What kind of “bet” is this investor making; that is, what must this investor believe about the stock price in order to justify this position?

Step by Step Answer:

ISE Essentials Of Investments

ISBN: 9781265450090

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus