Mr. Smart Lal commenced his trading business in the name of Exotica Trading Company on 1st April

Question:

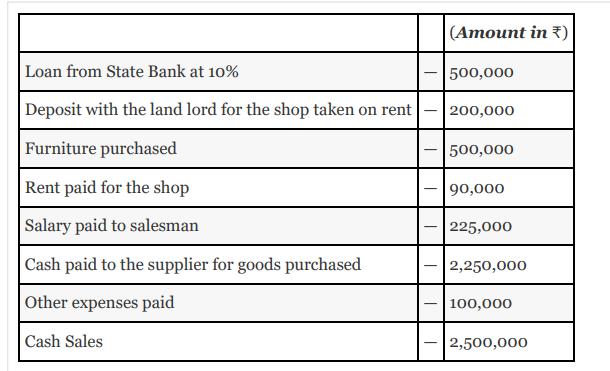

Mr. Smart Lal commenced his trading business in the name of Exotica Trading Company on 1st April 2017 with a capital of ₹ 1,000,000 and a loan from the State Bank of India amounting to ₹ 500,000. At the end of the first year, the summary of his business transactions recorded on cash basis are set out below:

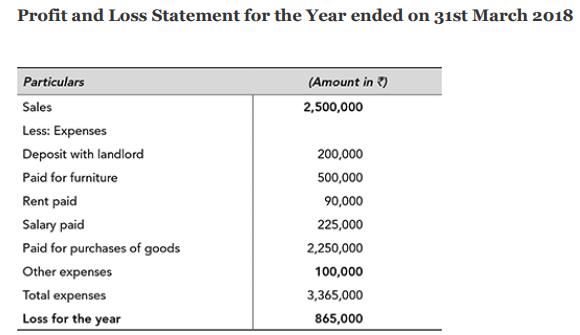

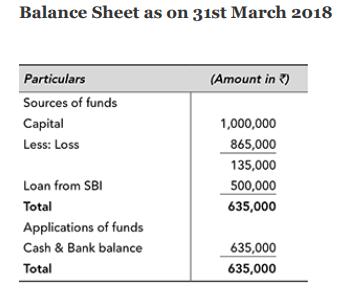

At the end of the year, he prepared the profit and loss statement and a balance sheet as given as follows:

Smart Lal is very upset about the results as in the first year of operations itself, the business has incurred a loss of ₹ 865,000. He is concerned about the prospects of this business going forward. While reviewing the accounts, he also come across some more information kept by his accountant:

• Rent for a quarter is still to be paid at ₹ 10,000 per month.

• Salary paid includes an advance given to the salesman amounting to ₹ 45,000.

• Interest on bank loan for the whole year is yet to be paid.

• Suppliers of goods are yet to be paid for the supplies made ₹ 150,000.

• Goods purchased for ₹ 50,000 were consumed at the household of Smart Lal.

• Goods costing ₹ 215,000 are still unsold and lying in the stock.

• Sales amounting to ₹ 325,000 are yet to be collected from the customers. One of the customer from whom ₹ 45,000 is due is feared to be insolvent.

• It is expected that furniture would have a useful life of five years. The current market value of similar furniture is ₹ 600,000.

Mr. Smart Lal is not too sure as to how to incorporate the above information in the financial results. Please help him by preparing the revised statement of profit and loss and balance sheet highlighting the accounting principle involved.

Step by Step Answer: