State Bank of India (SBI) is the oldest bank in India holding premier position in terms of

Question:

State Bank of India (SBI) is the oldest bank in India holding premier position in terms of balance sheet size, number of branches and market capitalization. It was adjudged as the best bank by the Business India in August 2009. The Government of India holds over 59% of the share capital of the bank with the balance 41% held by institutional investors (29%) and retail investors (12%).

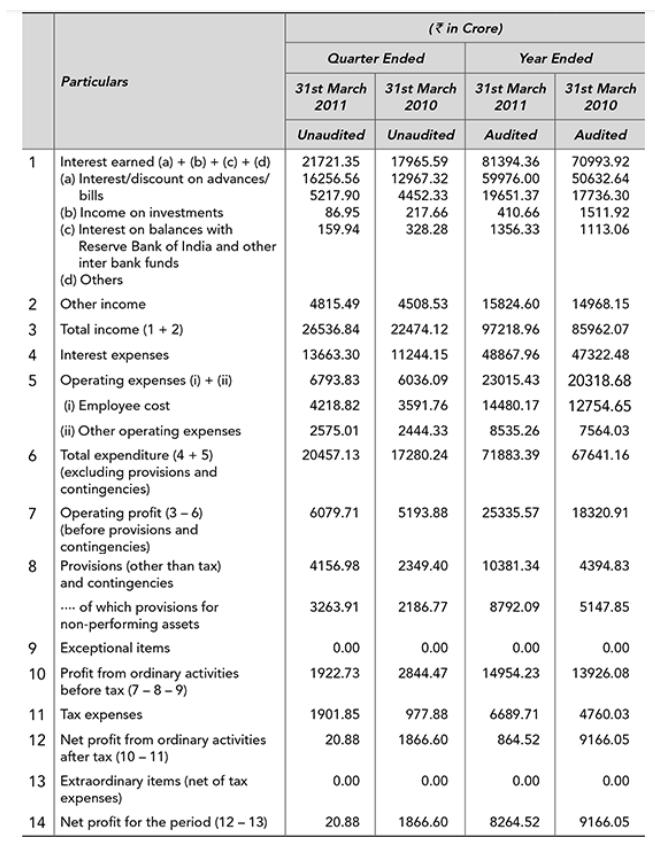

‘State Bank of India surprised the market by posting a 99% decline in net profit to ₹ 21 crore for the fourth quarter ended 31st March 2011 against ₹ 1,867 Crore during the corresponding period last year. Profits were dragged down by higher provisioning towards pension and gratuity and loan loss and standard assets provision on special home loan schemes.’ Though the income grew by 18% to ₹ 26,536 crore from ₹ 22,474 crore in the corresponding quarter in the past year, the net profit fell by 99%. The audited financial results as declared by the bank are reproduced below.

Audited Financial Results for the Year Ended 31st March 2011

While announcing the result, Mr. Pratip Chaudhuri—newly appointed chairman of the bank—said that ‘whether it is pension, provision coverage ratio or standard assets provisioning we have done a considerable cleanup act. In the interest of transparency, we have taken the hit this year itself so that, going forward, we have no legacy issues. For gratuity too, we could have amortized this expense over five years, we decided to load it upfront, so that the impact over the next 16 quarters will only be ₹ 25 crore’.

The ‘clean up act’ of SBI did not go too well with all concerned. ‘We have decided to send a letter to SBI to enquire about the reasons, which led to an increase in provisions, to explain a rise in provisions in the March quarter over that in December (2010) quarter. We would like to know the factual position about such high provisioning’. said the Institute of Chartered Accountants president to the Indian Express.

RBI Deputy Governor, K C Chakrabarty, also commented ‘Reporting has to be credible. You see our banks, when the chairman retires profits decline. If we don’t make the system credible and create a standard, people will report anything. Reporting should not be according to chairman but according to books. So we need to improve the standard of reporting and examination’.

However, the outgoing RBI Deputy Governor, Shyamala Gopinath, who is also on the board of SBI argued that ‘If a bank chooses to make a onetime provision, it is their choice and there is nothing wrong with it. The provisions toward gratuity, pensions and other annuities that SBI made in Q4 could have been staggered’.

The stock market reacted on the expected line after the result announcement. The SBI stock fell by almost 8%, from ₹ 2,617 on 16th May to ₹ 2,413 on the next day. The stock continued to fall and closed at ₹ 2,175 on 25th May 2011, a fall of over 17% in seven trading sessions. In the same period, the sensitive index (SENSEX) of the Bombay Stock Exchange fell by about 3% and the stock index of banking companies (BANKEX) fell by about 5%.

Questions for Discussion

1. Why do companies make provisions? Which accounting principle supports this?

2. What is the impact of overprovisioning on the reported profits of the company?

3. The principle of conservatism or prudence is against overreporting of profits. Does it justify underreporting of profits?

4. What is the impact if in the subsequent year some of the provisions made in the current period are found to be excessive?

5. Can these provisions be used by companies for earnings management?

Step by Step Answer: