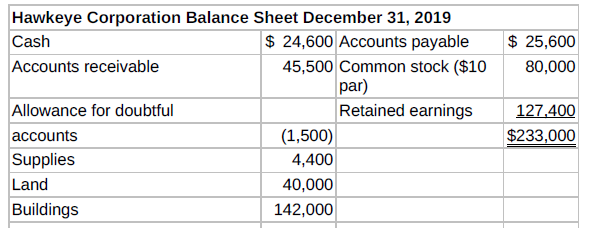

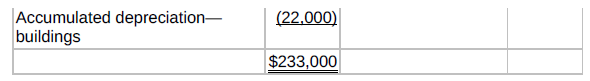

Hawkeye Corporation?s balance sheet at December 31, 2019, is presented below. During 2020, the following transactions occurred.

Question:

Hawkeye Corporation?s balance sheet at December 31, 2019, is presented below.

During 2020, the following transactions occurred.

1. On January 1, 2020, Hawkeye issued 1,200 shares of $40 par, 7% preferred stock for $49,200.

2. On January 1, 2020, Hawkeye also issued 900 shares of the $10 par value common stock for $21,000.

3. Hawkeye performed services for $320,000 on account.

4. On April 1, 2020, Hawkeye collected fees of $36,000 in advance for services to be performed from April 1, 2020, to March 31, 2021.

5. Hawkeye collected $276,000 from customers on account.

6. Hawkeye bought $35,100 of supplies on account.

7. Hawkeye paid $32,200 on accounts payable.

8. Hawkeye reacquired 400 shares of its common stock on June 1, 2020, for $28 per share.

9. Paid other operating expenses of $188,200.

10. On December 31, 2020, Hawkeye declared the annual preferred stock dividend and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2021.

11. An account receivable of $1,700 which originated in 2019 is written off as uncollectible.

Adjustment data:1. A count of supplies indicates that $5,900 of supplies remain unused at year-end.

2. Recorded revenue from item 4 above.

3. The allowance for doubtful accounts should have a balance of $3,500 at year end.

4. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $10,000.

5. The income tax rate is 30%. (Hint: Prepare the income statement up to income before income taxes and multiply by 30% to compute the amount.)

Instructions

(You may want to set up T-accounts to determine ending balances.)a. Prepare journal entries for the transactions listed above and adjusting entries.

b. Prepare an adjusted trial balance at December 31, 2020.

c. Prepare an income statement and a retained earnings statement for the year ending December 31, 2020, and a classified balance sheet as of December 31, 2020.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1119392132

3rd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso