John and Nina Hartwick, married 17 years, have a 13-year-old daughter. Eight years ago, they purchased a

Question:

John and Nina Hartwick, married 17 years, have a 13-year-old daughter. Eight years ago, they purchased a home on which they owe about $240,000. They also owe $6,000 on a two-year-old automobile. All of their furniture and their second car are paid for, but they owe a total of $5,320 on two credit cards. John is employed as an engineer and makes $85,000 a year. Mary works from home as a part-time graphic designer and earns about $22,000 a year. Their combined monthly income after deductions and their portion of employer-sponsored health care is $6,200.

About six months ago, the Hartwicks had what they now describe as a “financial meltdown.” It all started one Monday afternoon when the transmission on their second car had to be replaced. Although they thought it would be an easy fix, the mechanic told them that the transmission would need a complete overhaul. Unfortunately, the warranty on the automobile’s drive train components was for 5 years or 50,000 miles. Since this car was just over 6 years old, they would have to pay for the repair, and the mechanic said it would cost about $2,800 to rebuild the transmission. They thought about buying a new car, but they didn’t think they could afford or want two car payments.

At the time, they had about $3,500 in their savings account, which they had been saving for their summer vacation, and now they had to use their vacation money to fix the transmission.

For the Hartwicks, the fact that they didn’t have enough money to take a vacation was a wake-up call. They realized they were now in their late 30s and had serious cash problems. According to John, “We don’t waste money, but there just never seems to be enough money to do the things we want to do.” But according to Nina, “The big problem is that we never have enough money to start an investment program that could pay for our daughter’s college education or fund our retirement.”

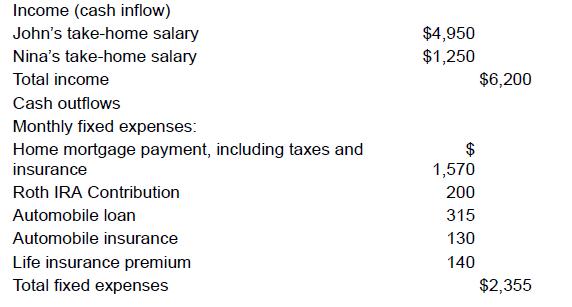

They decided to take a big first step in an attempt to solve their financial problems. They began by examining their monthly expenses for the past month. The table shows what they found.

Table Summary: This table consists of 3 columns. The only value in the third column is the total income, $6,200.

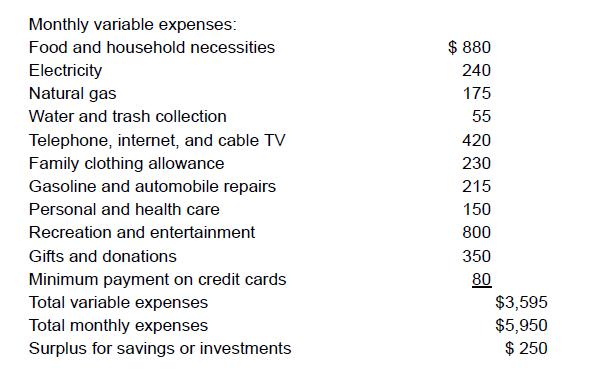

This table consists of 3 columns. The only values in the third column are "total fixed expenses," "total variable expenses," "total monthly expenses" and "surplus for savings or investments."

Once the Hartwicks realized they had a $250 surplus each month, they began to replace the $2,800 they had taken from their savings account to pay for repairing the transmission repair. Now it was time to take the next step.

Questions

1. How would you rate the financial health of the Hartwicks before their second automobile broke down?

2. The Hartwicks’ take-home pay is $6,200 a month. Yet, after all expenses are paid, there is only a $250 surplus each month.

Based on the information presented in this case, what expenses, if any, seem out of line and could be reduced to increase the surplus at the end of each month?

3. Given that both John and Nina Hartwick are in their late 30s and want to retire when they reach age 65, what type of investment goals would be most appropriate for them?

4. How does the time value of money and the asset allocation concept affect the types of long-term goals and the investments that a couple like the Hartwicks might use to build their financial nest egg?

5. Based on the different investments described in this chapter, what specific types of investments (stocks, bonds, mutual funds, real estate, etc.) would you recommend for the Hartwicks? Why?

Step by Step Answer:

Personal Finance

ISBN: 9781264101597

14th Edition

Authors: Jack Kapoor, Les Dlabay, Robert Hughes, Melissa Hart