Northeast Sales had the following transactions in 2011: 1. The business was started when it acquired ($

Question:

Northeast Sales had the following transactions in 2011:

1. The business was started when it acquired \(\$ 500,000\) cash from the issue of common stock.

2. Northeast purchased \(\$ 1,200,000\) of merchandise for cash in 2011.

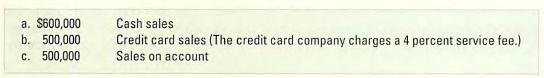

3. During the year, the company sold merchandise for \(\$ 1,600,000\). The merchandise cost \(\$ 900,000\). Sales were made under the following terms:

4. The company collected all the amount receivable from the credit card company.

5. The company collected \(\$ 400,000\) of accounts receivable.

6. The company paid \(\$ 100,000\) cash for selling and administrative expenses.

7. Determined that 5 percent of the ending accounts receivable balance would be uncollectible.

Required

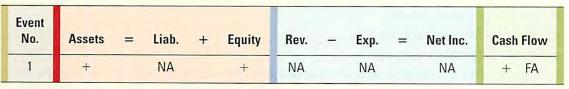

a. Show the effects of each of the transactions on the elements of the financial statements, using a horizontal statements model like the one shown here. Use + for increase, - for decrease, and NA for not affected. The first transaction is entered as an example. (Closing entries do not affect the statements model.)

b. Prepare general journal entries for each of the transactions, and post them to \(\mathrm{T}\)-accounts.

c. Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for 2011.

Step by Step Answer: