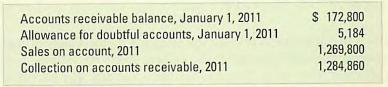

The following information is available for Book Barn Company's sales on account and accounts receivable: After several

Question:

The following information is available for Book Barn Company's sales on account and accounts receivable:

After several collection attempts, Book Barn wrote off \(\$ 4,500\) of accounts that could not be collected. Book Barn estimates that 4 percent of the ending accounts receivable balance will be uncollectible.

Required

a. Compute the following amounts:

(1) Using the allowance method, the amount of uncollectible accounts expense for 2011.

(2) Net realizable value of receivables at the end of 2011.

b. Record the general journal entries to:

(1) Record sales on account for 2011.

(2) Record cash collections from accounts receivable for 2011.

(3) Write off the accounts that are not collectible.

(4) Record the estimated uncollectible accounts expense for 2011.

c. Explain why the uncollectible accounts expense amount is different from the amount that was written off as uncollectible.

Step by Step Answer: