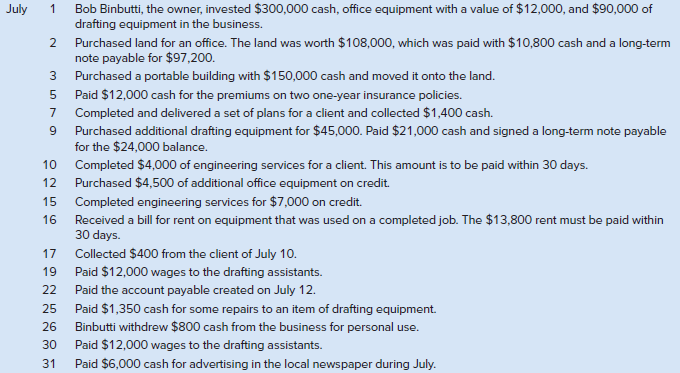

Binbutti Engineering, a sole proprietorship, completed the following transactions during July 2020, the third month of operations:

Question:

Binbutti Engineering, a sole proprietorship, completed the following transactions during July 2020, the third month of operations:

Required

1. Prepare journal entries to record the transactions. Use page 1 for the journal.

2. Set up the following general ledger accounts (use the balance column format or T-accounts), entering the balances brought forward from June 30, 2020: Cash (101) $26,000; Accounts Receivable (106) $3,000; Prepaid Insurance (128) $500; Office Equipment (163) $1,700; Drafting Equipment (167) $1,200; Building (173) $42,000; Land (183) $28,000; Accounts Payable (201) $1,740; Long-Term Notes Payable (251) $24,000; Bob Binbutti, Capital (301) $54,000; Bob Binbutti, Withdrawals (302) $1,000; Engineering Revenue (401) $29,600; Wages Expense (623) $4,000; Equipment Rental Expense (645) $1,000; Advertising Expense (655) $640; and Repairs Expense (684) $300.

3. Post the entries to the general ledger accounts and enter the balance after each posting.

4. Prepare a trial balance at July 31, 2020.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann