Selected results from Samsung, Apple, and Google follow. Required 1. Compute Samsungs debt-to-equity ratio for the current

Question:

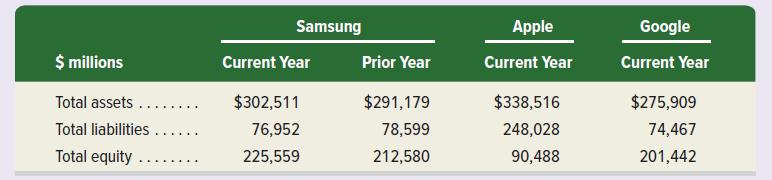

Selected results from Samsung, Apple, and Google follow.

Required

1. Compute Samsung’s debt-to-equity ratio for the current year and the prior year.

2. Is Samsung’s financing structure more risky or less risky in the current year versus the prior year?

3. In the current year, is Samsung’s financing structure more risky or less risky than

(a) Apple’s

(b) Google’s?

Transcribed Image Text:

Samsung Apple Google $ millions Current Year Prior Year Current Year Current Year Total assets ...... $302,511 $291,179 $338,516 $275,909 Total liabilities ...... 76,952 78,599 248,028 74,467 Total equity ...... 225,559 212,580 90,488 201,442

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 42% (14 reviews)

1 Samsungs current year debttoequity ratio 76952 225559 034 Samsungs prior year ...View the full answer

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Google recently had a debt to equity ratio of 0.04 .Microsoft , one of its let competitors a debt to ratio of 0.15 .From a banks point of view which of the company in es is more attractive loan...

-

Target sales Variable expenses Fixed expenses Operating income (loss). Units sold ... Contribution margin per unit Contribution margin ratio **** Q R S $ 720,000 $ 418,750 $ 236,000 216,000 $ 154,000...

-

Compute the following ratios for the current year with the date in the image: a. Current Ratio b. Cash Ratio c. Acid-test Ratio d. Inventory turnover e. Days' sales in inventory f. Days' sales in...

-

How important is the ability of international managers to undertake cultural interpretation work to the subsequent success of international strategies?

-

A control mass gives out 10 kJ of energy in the form of a. Electrical work from a battery b. Mechanical work from a spring c. Heat transfer at 500C Find the change in availability of the control mass...

-

A professor records the majors of her 30 students as follows: a. What is the measurement scale of these data? b. Summarize the results in tabular form. c. What information can be extracted from...

-

The production budget of Hinsdale Company calls for 90,000 units to be produced. If it takes 30 minutes to make one unit and the direct labor rale is s ] 4 per hour, what is the total budgeted direct...

-

Rodeo & Blue Inc (RBI) has been a remarkable success story over the past four years. Starting from a small basement operation, it has quickly grown to a worldwide leader in the music industry. It is...

-

MY NO A homeowner planning a kitchen remodeling can afford a $300 monthly payment. How much can the homeowner borrow for 4 years at 6%, compounded monthly, and still stay within the budget (Round...

-

Mary Robinson, vice president of marketing for a famous mens dress shirt manufacturer, had spent three months working on the in-store promotional campaign to be used for the new all cotton, easy-care...

-

Ripkin Company issues 9%, five-year bonds dated January 1, 2021, with a $320,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $332,988. Their annual...

-

Break into teams and complete the following requirements related to effective interest amortization for a premium bond. 1. Each team member is to independently prepare a blank table with proper...

-

ESPN would like to determine if the number of hours fantasy football players spend during the week managing their teams has increased since last year. A random sample of players was chosen, and the...

-

explain the role of organismal genetics in determining individual variation in traits, and how this variation contributes to natural selection, evolution, and species diversification over time ?

-

Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates for budgeting purposes...

-

What are the mechanisms underlying genetic variation at the molecular level, including single nucleotide polymorphisms (SNPs), copy number variations (CNVs), and structural rearrangements, and how do...

-

Question 3 B [Soalan 3] (a) A conveyor system consists of EIGHT(8) major components of which all components must be working in order for the overall system to function. As illustrated below in Figure...

-

In making the correct diagnosis, it was important to know that Carls serum albumin level was normal. Why? Why was Carls urinary Ca 2+ excretion elevated (hypercalciuria)? What was the relationship...

-

Barot's 2018 financial statements reported the following items-with 2017 figures given for comparison: Net income for 2018 was $3,910, and interest expense was $240. Compute Barot's rate of return on...

-

Describe basic managerial approaches to implementing controls and how these are implemented.

-

What is the reporting purpose of the statement of cash flows? Identify at least two questions that this statement can answer.

-

Describe the direct method of reporting cash flows from operating activities. Discuss in detail.

-

When a statement of cash flows is prepared using the direct method, what are some of the operating cash flows?

-

Nancy is 21 and a full-time college student and is blind. Nancy lives with her mother and is claimed as a dependent by her mother. Her earned income was $6,500 for the 2022 tax year. Using the...

-

Christopher Foley, an attorney, has a law corporation, Christopher Foley, Attorney, Inc., that began the year with total assets of $145,000, total liabilities of $70,000, and stockholders' equity of...

-

Which of the following statements is correct? Group of answer choices All of these answers are correct. A subscriber must take reasonable steps to offer users a receipt for all transactions, before...

Study smarter with the SolutionInn App