Assume that you are considering purchasing shares as an investment. You have narrowed the choice to two

Question:

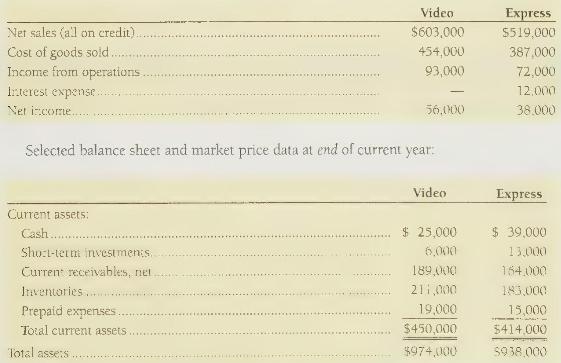

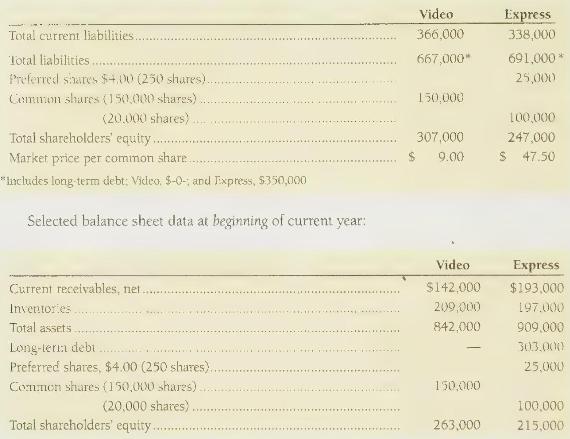

Assume that you are considering purchasing shares as an investment. You have narrowed the choice to two Internet firms, Video.com Inc. and On-Line Express Ltd., and have assembled the following data.

Selected income statement data for current year:

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

{Requirement}

Compute the following ratios for both companies for the current year and decide which company's shares better fit your investment strategy:

a. Quick (acid-test) ratio

b. Inventory turnover

c. Days' sales in receivables

d. Debt ratio

e. Times-interest-earned ratio

f. Return on equity g. Earnings per share h. Price/earnings ratio

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin