Use the financial statements of Allstott, Inc., in exercises 10-6 and 10-7. 1. Compute the company's debt

Question:

Use the financial statements of Allstott, Inc., in exercises 10-6 and 10-7.

1. Compute the company's debt ratio at December \(31,2020\).

2. Compute the company's times-interest-earned ratio for 2020. For operating income, use income before both interest expense and income taxes. You can simply add interest expense back to income before taxes.

3. Is Allstott's ability to pay liabilities and interest expense strong or weak? Comment on the value of each ratio computed for questions 1 and 2 .

Exercises 10-6

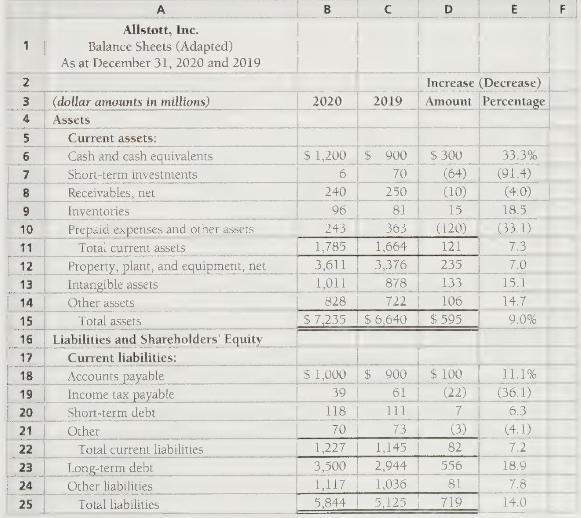

Use the Allstott, Inc., balance sheet data below.

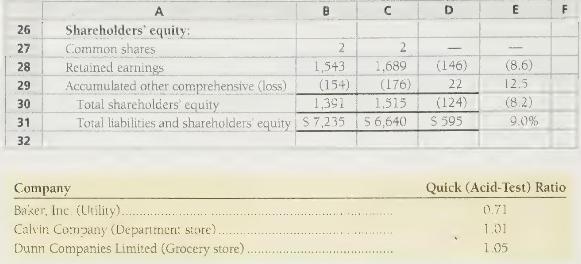

1. Compute Allstott, Inc.'s quick (acid-test) ratio at December 31, 2020 and 2019.

2. Use the comparative information from the table on page 597 for Baker, Inc., Calvin Company, and Dunn Companies Limited. Is Allstott's quick (acid-test) ratio for 2020 and 2019 strong, average, or weak in comparison?

Exercises 10-7

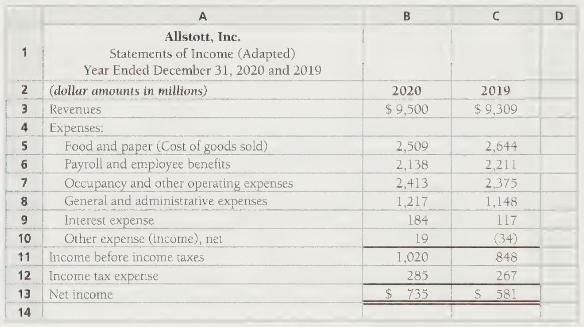

Use the Allstott 2020 income statement that follows and the balance sheet from exercise 10-6 to compute the following:

a. Allstott's rate of inventory turnover and days inventory outstanding for 2020

b. Days' sales in average receivables (days sales outstanding) during 2020 (round dollar amounts to one decimal place)

c. Accounts payable turnover and days' payables outstanding

d. Length of cash conversion cycle in days Do these measures look strong or weak? Give the reason for your answer.

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin