On October 1, 2011, Hanks Company entered into a forward contract to sell 100,000 LCUs in four

Question:

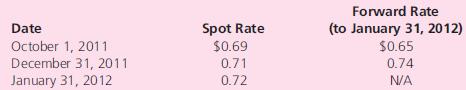

On October 1, 2011, Hanks Company entered into a forward contract to sell 100,000 LCUs in four months (on January 31, 2012) and receive $65,000 in U.S. dollars. Exchange rates for the LCU follow:

Jackson’s incremental borrowing rate is 12 percent. The present value factor for one month at an annual interest rate of 12 percent (1 percent per month) is 0.9901. Jackson must close its books and prepare its third-quarter financial statements on September 30.

a. Prepare journal entries for the forward contract and firm commitment.

b. What is the impact on net income over the two accounting periods?

c. What net cash outflow results from the purchase of merchandise from the foreign customer?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: