Use the information in problem 40 to prepare the 2010 fund-based financial statements for the governmental funds

Question:

Use the information in problem 40 to prepare the 2010 fund-based financial statements for the governmental funds and the proprietary funds. A statement of cash flows is not required. Assume that

“available” is defined as within 60 days and that all funds are major. The General Fund is used for debt repayment.

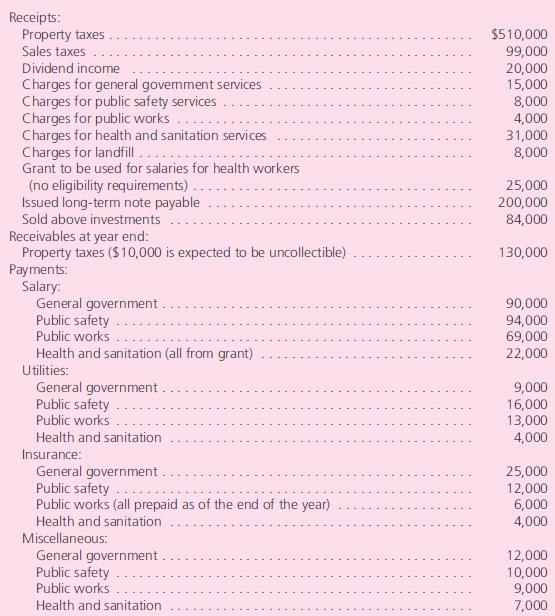

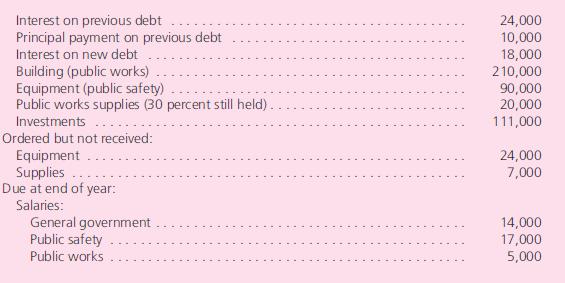

Problem 40

The City of Bernard starts the year of 2010 with the following unrestricted amounts in its General Fund: cash of \($20,000\) and investments of \($70,000\). In addition, it holds a building bought on January 1, 2009, for general government purposes for \($300,000\) and related long-term debt of

\($240,000\). The building is being depreciated on the straight-line method over 10 years. The interest rate is 10 percent. The General Fund has four separate functions: general government, public safety, public works, and health and sanitation. Other information includes the following:

The city leased a truck on the last day of the year. The first payment will be made at the end of the next year. Total payments will amount to \($90,000\) but have a present value of \($64,000\). The city started a landfill this year that it is recording within its General Fund. It is included as a public works function. Closure costs today would be \($260,000\) although the landfill is not expected to be filled for nine more years. The city has incurred no costs to date although the landfill is now 15 percent filled.

For the equipment and supplies that have been ordered but not yet received, the City Council (the highest decision-making body in the government) has voted to honor the commitment when the items are received.

The new building is being depreciated over 20 years using the straight-line method and no salvage value, whereas depreciation of the equipment is similar except that its life is only 10 years.

Assume the city records a full year’s depreciation in the year of acquisition.

The investments are valued at \($116,000\) at year-end.

a. Prepare a statement of activities and a statement of net assets for governmental activities for December 31, 2010, and the year then ended.

b. Prepare a statement of revenues, expenditures, and changes in fund balances and a balance sheet for the General Fund as of December 31, 2010, and the year then ended. Assume that the purchases method is being applied.

Step by Step Answer: