Question:

A. Steve Jackson (birthdate December 13, 1965) is a single taxpayer living at 3215 Pacific Dr., Apt. B, Pacific Beach, CA 92109. His Social Security number is 465-88-9415. In 2018, Steve’s earnings and income tax withholding as laundry attendant of a local hotel are:

Earnings from the Ocean View Hotel................$21,500

Federal income tax withheld................215

State income tax withheld................100

Steve has a daughter, Janet, from a previous marriage. Janet is 11 years old (Social Security number 654-12-6543). Steve provides all Janet’s support. Also living with Steve is his younger brother, Michael (Social Security number 667-21-8998). Michael, age 47, is unable to care for himself due to a disability. On a reasonably regular basis, Steve has a care giver come to the house to help with Michael. He uses a company called HomeAid, 456 La Jolla Dr., San Diego, CA 92182 (EIN 17-9876543). Steve made payments of $990 to HomeAid in 2018. Janet receives free after-school care provided by the local school district.

Required:

Complete Steve’s federal tax return for 2018. Use Form 1040, Schedule 3, Form 2441, Child Tax Credit Worksheet, Form 8812, EITC Worksheet A, and Schedule EIC.

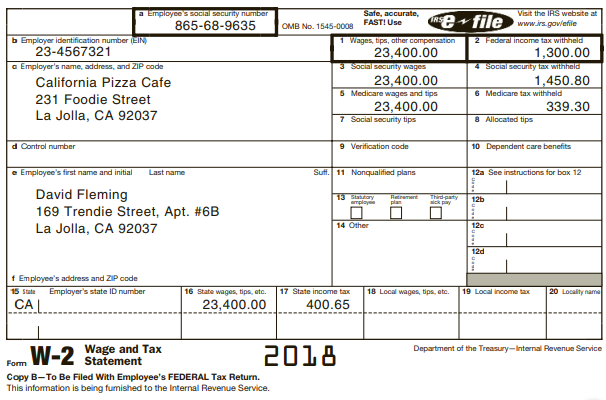

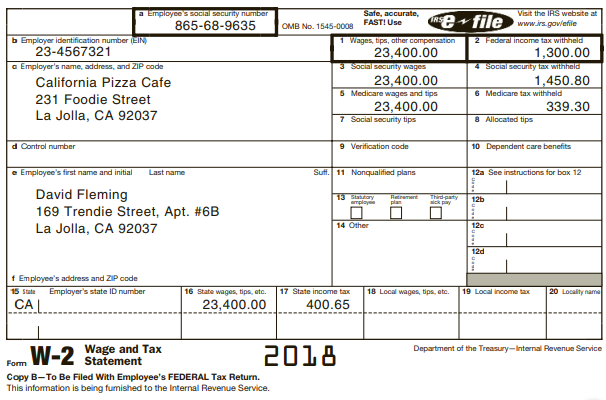

B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1973. David was employed as a delivery person for a local pizza restaurant. David’s W-2 showed the following:

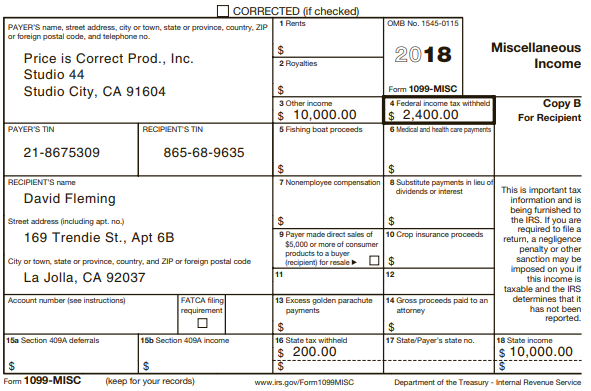

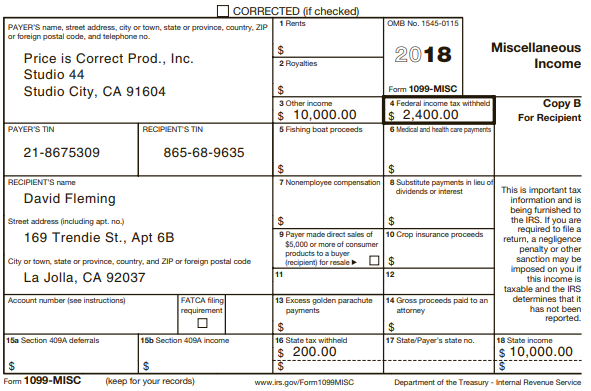

David’s only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC:

He has no other adjustments to income or deductible expenses. Unfortunately, David’s employer did not provide health care to its employees but David signed up for coverage through his state’s health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-63.

Required:

Complete David’s federal tax return for 2018. Use Form 1040, Schedule 1, Schedule 2, and Form 8962. Make realistic assumptions about any missing data.

Transcribed Image Text:

a Employee S SOcial security number Safe, accurate, FAST! Use Visit the IAS website at www.irs.gow/efile RSe file 865-68-9635 OMB No. 1545-0008 b Employer identification number (EIN 23-4567321 1 Wages, tips, other compensation 23,400.00 Social security wages 2 Federal income tax withheld 1,300.00 4 Social security tax withheld a Employer's name, address, and ZIP code 1,450.80 6 Medicare tax withheld 23,400.00 5 Medicare wages and tips California Pizza Cafe 231 Foodie Street 23,400.00 7 Social security tips 339.30 La Jolla, CA 92037 8 Allocated tips d Control number 10 Dependent care benefits 9 Verification code e Employee's first name and initial Suff. 11 Nonqualified plans 12a See instructions for bax 12 Last name David Fleming 169 Trendie Street, Apt. #6B La Jolla, CA 92037 13 Stay mployee வா் plan Thind paty ck pay 12b 14 Other 120 12d f Employee's address and ZIP code Emplayer's state ID number 17 State income tax 15 state 16 State wages, tips, etc. 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 400.65 23,400.00 Wage and Tax W-2 Statement Department of the Treasury-Internal Revenue Service 2018 Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being fumished to the Internal Revenue Service. O CORRECTED (if checked) 1 Rents OMB No. 1545-0115 PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Miscellaneous Income Price is Correct Prod., Inc. 24 2018 2 Rayalties Studio 44 Studio City, CA 91604 Farm 1099-MISC Copy B 3 Other income 4 Federal income tax withheld $ 10,000.00 5 Fishing boat proceeds $ 2,400.00 6 Medical and health care payments For Recipient PAYER'S TIN RECIPIENT'S TIN 21-8675309 865-68-9635 RECIPIENT'S name 7 Nonemployee compensation 8 Substitute payments in lieu of This is important tax information and is being furnished to the IRS. If you are required to file a returm, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS dividends or interest David Fleming 2$ 9 Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale Street address (including apt. no.) 169 Trendie St., Apt 6B 10 Crop insurance proceeds 2$ City or town, state or province, country, and ZIP or foreign postal code La Jolla, CA 92037 11 12 FATCA filing requirement 13 Excess golden parachute payments determines that it has not been Account number (see instructions) 14 Gross proceeds paid to an attorney reported. 24 2$ 15a Section 40SA deferrals 15b Section 40SA income 16 State tax withheld 17 State/Payer's state no. 18 State income $ 200.00 $ 10,000.00 24 Fom 1099-MISC (keep for your records) www.irs.gowFom1099MISC Department of the Treasury - Internal Revenue Service