During the 2018 tax year, Brian, a single taxpayer, received $7,400 in Social Security benefits. His adjusted

Question:

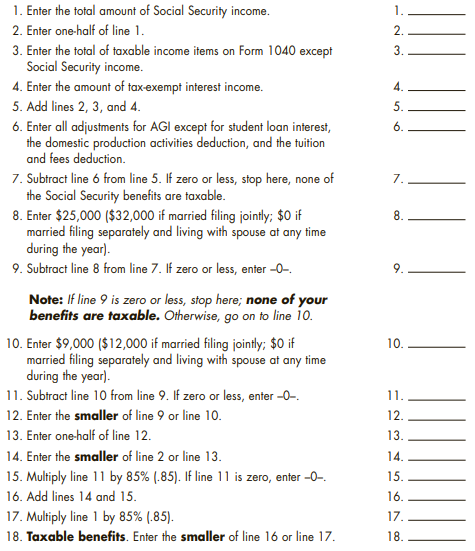

During the 2018 tax year, Brian, a single taxpayer, received $7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $30,000 in tax-exempt interest income and has no for-AGI deductions. Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2018.

Transcribed Image Text:

1. Enter the total amount of Social Security income. 1. 2. Enter one-half of line 1. 2. 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 3. 4. 5. Add lines 2, 3, and 4. 5. 6. Enter all adjustments for AGI except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 6. 7. Subtract line 6 from line 5. If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $25,000 ($32,000 if married filing jointly; $0 if married filing separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter -0-. 7. 8. Note: If line 9 is zero or less, stop here; none of your benefits are taxable. Otherwise, go on to line 10. 10. Enter $9,000 ($12,000 if married filing jointly; $0 if married filing separately and living with spouse at any time during the year). 11. Subtract line 10 from line 9. If zero or less, enter -0-. 10. 11. 12. Enter the smaller of line 9 or line 10. 12. 13. Enter one-half of line 12. 13. 14. Enter the smaller of line 2 or line 13. 14. 15. Multiply line 11 by 85% (.85). If line 11 is zero, enter -0-. 15. 16. 16. Add lines 14 and 15. 17. Multiply line 1 by 85% (.85). 17. 18. Taxable benefits. Enter the smaller of line 16 or line 17. 18.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 86% (15 reviews)

1 Enter the total amount of social security income 2 Enter onehalf of line 1 3 Enter the total of ta...View the full answer

Answered By

Omar ELmoursi

I'm Omar, I have Bachelor degree in Business and Finance, My unique approach is to help students with questions and assignments, I can teach Business, Math, Accounting, Managerial Accounting, Economy, Human resources management, organizational behavior, project management, I have experience dealing with different types of students and teach them how to deal with different types of exercises.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During the 2014 tax year, Brian, a single taxpayer, received $6,000 in Social Security benefits. His adjusted gross income for the year was $18,000 (not including the Social Security benefits) and he...

-

During the 2013 tax year, Brian, a single taxpayer, received $6,000 in Social Security benefits. His adjusted gross income for the year was $18,000 (not including the Social Security benefits) and he...

-

During the 2016 tax year, Brian, a single taxpayer, received $7,200 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he...

-

If Euros sell for $1.50 per euro, what should dollars sell for in Euros per dollar?

-

Switching to International Financial Reporting Standards (IFRS) will require companies to incur significant costs. What are the benefits of countries adopting IFRS?

-

Discuss new guidelines by the FTC regarding online privacy protection for adults?

-

What are the reasons for most companies having a poorly co-ordinated collection of environmental data? How are these reasons related to the distinction made between fixed and variable costs of...

-

A counter flow, concentric tube heat exchanger used for engine cooling has been in service for an extended period of time. The heat transfer surface area of the exchanger is 5 m 2 , and the design...

-

Sebastian operates a small business with his wife Ariel. They have no other employees. They have $240,000 of assets in the plan. Must they file any forms with the IRS? If yes, which? What if they had...

-

An ice-cube tray of negligible mass contains 0.350 kg of water at 18.0C. How much heat must be removed to cool the water to 0.00C and freeze it? Express your answer in joules, calories, and Btu.

-

Which of the following is not a test for the deductibility of a business expense? a. Ordinary and necessary test b. Expectation of profit test c. Reasonableness test d. Business purpose test

-

For 2018, the minimum percentage of Social Security benefits that could be included in a taxpayers gross income is: a. 0% b. 25% c. 50% d. 75% e. 85%

-

What is the hybridization of each carbon atom in benzene? What shape do you expect benzene to have? H H-C H C=C C-C H C-H H Benzene

-

Alessia has her $ 3 , 2 0 0 savings in an account earning 6 3 5 % annual interest that is compounded continuously. How much will be in the account at the end of 5 1 2 years? Include a dollar sign in...

-

A loan is being repaid by quarterly installments of $ 1 , 5 0 0 at the end of each quarter at a nominal interest rate of 1 0 % convertible quarterly. if the loan balance at the end of the first year...

-

Petra is evaluating energy stocks, as oil prices have started to steadily rise after a decade of being in a slump. Permian Oil is currently trading at $5.89 a share. It distributes virtually all of...

-

Based on the data available in S&P, what is your estimate of the intrinsic value of the stocks using free cash flow (FCF) and the discounted cash flow (DCF) model? Please state your assumptions...

-

For the two independent cases that follow, determine the missing amount for each letter. (Hint: You might not be able to calculate them in the order in which they appear.) s Case 2 Revenues Expenses...

-

What characteristics of the social system affect an innovations acceptance within a market?

-

Write a paper about medication error system 2016.

-

In which of the following ways are tax returns selected for most audits? a. Through the Discriminant Function System b. Through informants c. Through news sources d. Through information matching

-

Which of the following is not a penalty that may be imposed by the IRS? a. Failure-to-file penalty b. Failure-to-pay penalty c. Penalty for negligence d. Fraud penalty e. All of the above may be...

-

If a taxpayers 2016 individual income tax return was filed on March 3, 2017, the statute of limitations would normally run out on: a. April 15, 2019 b. March 3, 2016 c. April 15, 2020 d. March 3,...

-

Explain how improvements to organizational systems can ensure successful and sustained behavioral change. How would mitigate and remove any roadblocks in the change management process? What are plans...

-

Discuss and describe transactional leadership in term of management. ?

-

How would each leadership style ( transactional leadership and transformational leadership) approach communication with various stakeholders?

Study smarter with the SolutionInn App