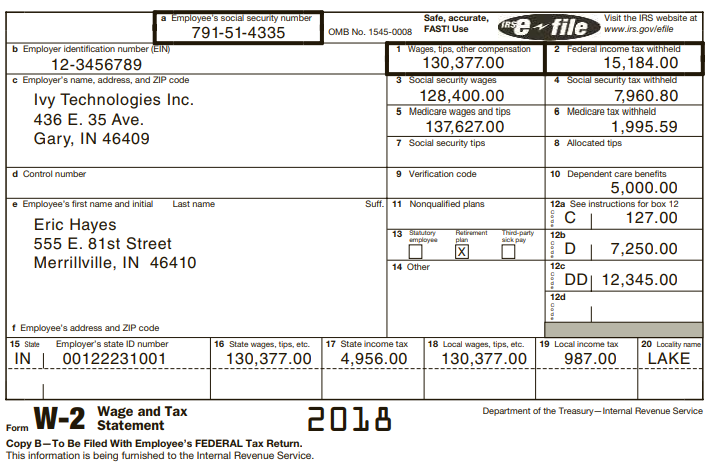

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help.

Question:

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Eric’s 2018 salary was $145,000 and he does not understand why the amounts in Boxes 1, 3 and 5 are not $145,000? His final paycheck for the year included the following information:

- Eric contributed 5 percent of his salary to the company 401(k) plan on a pre-tax basis.

- Eric is married with two children. He had $5,000 deducted from his wages for a Dependent Care Flexible Spending Account.

- Eric is enrolled in the company-sponsored life insurance program. He has a policy that provides a benefit of $145,000.

- Eric contributed $2,500 to the Health Care Flexible Spending Account (he keeps forgetting that the maximum deferral has increased over the years).

Using the information and Eric’s Form W-2, prepare an email to Eric reconciling his salary of $145,000 to the amounts in Boxes 1, 3, and 5.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted: