A review of the ledger of Hashmi Company at July 31, 2024, produces the following data for

Question:

A review of the ledger of Hashmi Company at July 31, 2024, produces the following data for the preparation of annual adjusting entries:

1. Prepaid Insurance, July 31, 2024, unadjusted balance, $15,840. The company has separate insurance policies on its buildings and its motor vehicles. Policy B4564 on the buildings was purchased on September 1, 2023, for $10,440. The policy has a term of two years. Policy A2958 on the vehicles was purchased on March 1, 2024, for $5,400. This policy has a term of one year.

2. Prepaid Rent, July 31, 2024, unadjusted balance, $6,350. The company has prepaid rental agreements for two pieces of equipment. The first one costs $335 per month and is for February 28, 2024, to December 31, 2024. The other costs $375 per month and is for December 1, 2023, to August 1, 2024. The company paid the full amount for each rental agreement at the start of the rental period.

3. Buildings, July 31, 2024, balance, $291,960. The first, purchased for $127,800 on September 1, 2005, has an estimated 30-year useful life. The second, purchased for $164,160 on May 1, 2007, has an estimated 40-year useful life.

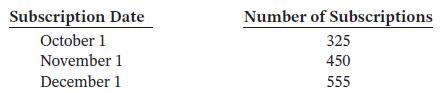

4. Unearned Revenue, July 31, 2024, unadjusted balance, $46,550. The company began selling magazine subscriptions in 2023. The selling price of a subscription is $35 for 12 monthly issues. Customers start receiving the magazine in the month the subscription is purchased. A review of subscription contracts that customers have paid for prior to July 31 reveals the following:

5. Salaries Payable, July 31, 2024, unadjusted balance, $0. There are nine salaried employees, each of whom is paid every Monday for the previous week (Monday to Friday). Six employees receive a salary of $650 each per week, and three employees earn $850 each per week. July 31 is a Wednesday.

Instructions

a. Prepare the adjusting entries at July 31, 2024. Show all your calculations.

b. For item 3, calculate the accumulated depreciation and carrying amount of each building on July 31, 2024.

Taking It Further

What is the purpose of recording depreciation? Why is land not depreciated?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak