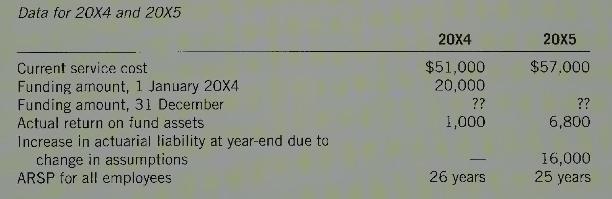

Markon Consultants Limited began a pension fund in the year 20X3, effective 1 January 20X4. Terms of

Question:

Markon Consultants Limited began a pension fund in the year 20X3, effective 1 January 20X4. Terms of the pension plan follow:

- The expected earnings rate on plan assets is \(6 \%\).

- Employees will receive partial credit for past service. The past service obligation, valued using the projected benefit actuarial cost method and a discount rate of \(6 \%\), is \(\$ 216,000\) as of 1 January \(20 \mathrm{X} 4\).

- Past service cost will be funded over 15 years. The initial payment, on 1 January 20X4, is \(\$ 20,000\). After that, another \(\$ 20,000\) will be added to the 31 December current service funding amount, including the 31 December 20X4 payment. The amount of past service funding will be reviewed every five years to ensure its adequacy.

- The past service cost vests over five years.

- Current service cost will be fully funded each 31 December, plus or minus any actuarial or experience gains related to the pension liability. Experience gains and losses related to the difference between actual and expected earnings on fund assets will not affect plan funding in the short run, as they are expected to offset over time.

Required:

1. Prepare a spreadsheet containing all relevant pension information. The company follows the practice of amortizing actuarial gains and losses to pension expense when the amount at the beginning of the year is outside the \(10 \%\) corridor.

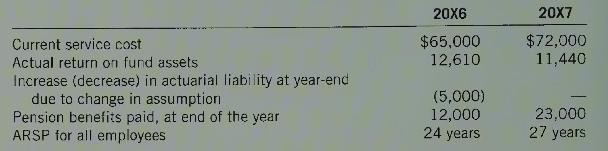

2. Complete a spreadsheet for \(20 \times 6\) and 20X7. Further data for Markon Consultants related to \(20 \mathrm{X} 6\) and \(20 \times 7\) is as follows:

3. Prepare journal entries to record pension expense and funding for \(20 \mathrm{X} 4\) through \(20 \mathrm{X} 7\).

Step by Step Answer: