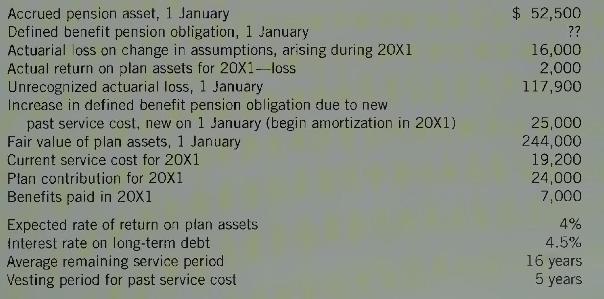

Scharf Limited has a defined benefit pension plan. The following information relates to this plan: Required: 1.

Question:

Scharf Limited has a defined benefit pension plan. The following information relates to this plan:

Required:

1. Calculate pension expense for \(20 \times 1\), and the closing balance of the recorded accrued pension asset. Reconcile the recorded pension asset balance to the assets and defined benefit obligation of the pension plan. The company uses the \(10 \%\) corridor method for actuarial gains and losses.

2. Does the statement of financial position reflect the economic position of the plan? Comment.

3. Describe the note disclosures that the company is required to include with respect to this plan.

4. Calculate pension expense assuming that the company recognizes all the actuarial gains and losses in reserves, with the annual change included as an element of other comprehensive income. There are no opening unrecognized amounts in this case, and, at the beginning of \(20 \mathrm{X} 1\), there is a \(\$ 65,400\) accrued pension liability. Cumulative reserves have a debit balance of \(\$ 117,900\) with respect to the pension. What are the closing SFP balances? Does the SFP reflect the economic position of the plan? Comment.

Step by Step Answer: