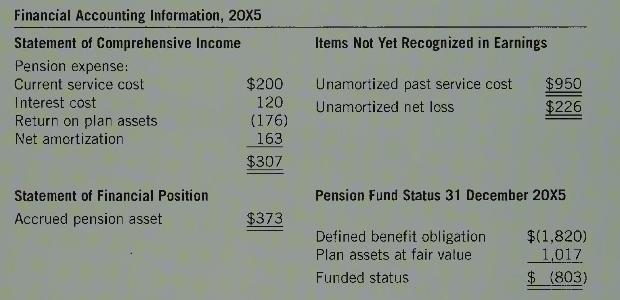

The following information relates to the contributory defined benefit pension plan of Daniels Corporation: The information was

Question:

The following information relates to the contributory defined benefit pension plan of Daniels Corporation:

The information was prepared for the 20X5 annual financial statements and is accurate; the pension plan terms granted PSC entitlements in 20X2 when the plan was amended. The president of Daniels Corporation has asked for clarification of the following:

a. What likely caused the unrecognized net loss (\$226) and why is it not recognized immediately?

b. What is the nature of the net amortization in the calculation of pension expense and why does it increase pension expense?

c. If the plan is underfunded by \(\$ 803\), why does the company show an accrued pension asset of \(\$ 373\) (i.e., what does this \(\$ 373\) represent?)

d. Which of the above measurements are dependent on estimates? Explain.

e. In general, how long is the amortization period for past service cost?

Required:

Respond to the requests of the company president.

Step by Step Answer: