Beck-Curry Associates reported the following income information for the 20192021 period: The company does not have any

Question:

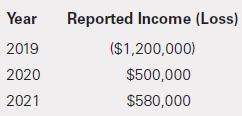

Beck-Curry Associates reported the following income information for the 2019–2021 period:

The company does not have any book-tax differences and is subject to a 21% income tax rate. Beck-Curry is filing a US Corporate Income Tax Return.

Required

a. Prepare the journal entry to record the 2019 income tax provision.

b. Prepare the journal entry to record the 2020 income tax provision.

c. Prepare the journal entry to record the 2021 income tax provision.

d. Determine the balance of the deferred tax asset at the end of 2021.

e. Assume that a newly enacted tax law increases the income tax rate to 25% on January 2, 2022. Prepare the journal entry to record the effects of the tax rate change.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella