Martineau Inc., a major retailer of high-end office furniture, operates several stores and is a publicly traded

Question:

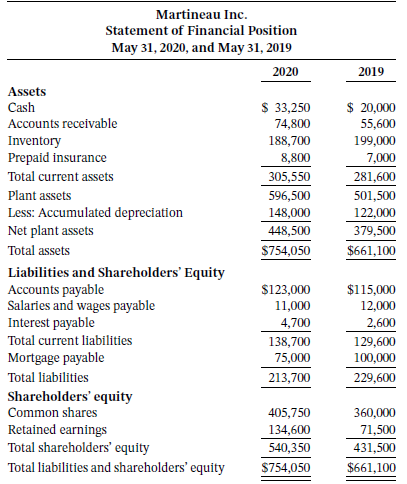

Martineau Inc., a major retailer of high-end office furniture, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows. The comparative statement of financial position and income statement for Martineau as at May 31, 2020, are as follows:

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Martineau Inc.? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Income Statement? ? ? ? ? ? ? ?For the Year Ended May 31, 2020Sales ............................................................................... $945,000Cost of goods sold ........................................................ 414,000Gross margin ................................................................. 531,000ExpensesSalaries and wages expense ........................................ 207,800Other operating expenses ............................................ 120,000Depreciation expense ..................................................... 26,000Total operating expenses ............................................. 353,800Operating income ......................................................... 177,200Interest expense .............................................................. 26,700Income before income tax ........................................... 150,500Income tax expense ........................................................ 55,400Net earnings .................................................................. $ 95,100

The following is additional information about transactions during the year ended May 31, 2020 for Martineau Inc., which follows IFRS.

1. Plant assets costing $95,000 were purchased by paying $64,000 in cash and issuing 5,000 common shares.

2. In order to supplement its cash, Martineau issued 4,000 additional common shares.

3. Cash dividends of $48,000 were declared and paid at the end of the fiscal year.

Instructions

a. Prepare a statement of cash flows for Martineau Inc. for the year ended May 31, 2020 using the direct method. Support the statement with appropriate calculations, and provide all required disclosures.

b. Using the indirect method, calculate only the net cash flow from operating activities for Martineau Inc. for the year ended May 31, 2020.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy