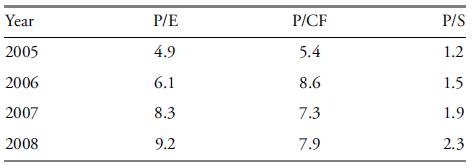

An analyst has prepared a table of the average trailing 12-month price-to-earning (P/E), price-to-cash flow (P/CF), and

Question:

An analyst has prepared a table of the average trailing 12-month price-to-earning (P/E), price-to-cash flow (P/CF), and price-to-sales (P/S) for the Tanaka Corporation for the years 2005 to 2008.

As of the date of the valuation in 2009, the trailing 12-month P/E, P/CF, and P/S are, respectively, 9.2, 8.0, and 2.5. Based on the information provided, the analyst may reasonably conclude that Tanaka shares are most likely:

A. Overvalued.

B. Undervalued.

C. Fairly valued.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard

Question Posted: