You are the management accountant of the SSA Group that manufactures an innovative range of products to

Question:

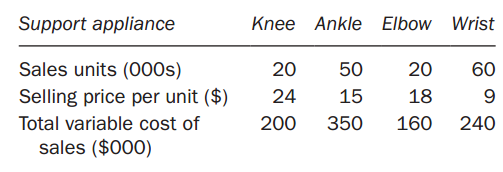

You are the management accountant of the SSA Group that manufactures an innovative range of products to provide support for injuries to various joints in the body. The group has adopted a divisional structure. Each division is encouraged to maximize its reported profit.Division A, which is based in a country called Nearland, manufactures joint support appliances that incorporate a ?one-size-fits-all people? feature. A different appliance is manufactured for each of knee, ankle, elbow and wrist joints.Budget information in respect of Division A for the year ended 31 December 2018 is as follows:

Each of the four support products uses the same quantity of manufacturing capacity. This gives Division A management the flexibility to alter the product mix as desired. During the year to 31 December 2018, it is estimated that a maximum of 160 000 support products could be manufactured.The following information relates to Division B which is also part of the SSA group and is based in Distantland:1. Division B purchases products from various sources, including from other divisions in SSA group, for subsequent resale to customers.2. The management of Division B has requested two alternative quotations from Division A in respect of the year ended 31 December 2018 as follows:Quotation 1 ? Purchase of 10 000 ankle supports.Quotation 2 ? Purchase of 18 000 ankle supports

The management of the SSA Group has decided that a minimum of 50 000 ankle supports must be reserved for customers in Nearland in order to ensure that customer demand can be satisfied and the product?s competitive position is maintained in the Nearland market.The management of the SSA Group is willing, if necessary, to reduce the budgeted sales quantities of other types of joint support in order to satisfy the requirements of Division B for ankle supports. They wish, however, to minimize the loss of contribution to the Group.The management of Division B is aware of another joint support product, which is produced in Distantland, that competes with the Division A version of the ankle support and which could be purchased at a local currency price that is equivalent to $9 per support. SSA Group policy is that all divisions are allowed autonomy to set transfer prices and purchase from whatever sources they choose. The management of Division A intends to use market price less 30 percent as the basis for each of quotations 1 and 2.

Required:(a) ?(i) The management of the SSA Group has asked you to advise regarding the appropriateness of the decision by the management of Division A to use an adjusted market price as the basis for the preparation of each quotation and the implications of the likely sourcing decisions by the management of Division B.Your answer should cite relevant quantitative data and incorporate your recommendation of the prices that should be quoted by Division A for the ankle supports in respect of quotations 1 and 2, which will ensure that the profitability of SSA Group as a whole is not adversely affected by the decision of the management of Division B.(ii) Advise the management of Divisions A and B regarding the basis of transfer pricing that should be employed in order to ensure that the profit of the SSA Group is maximized.(b) After considerable internal discussion concerning Quotation 2 by the management of SSA Group, Division A is not prepared to supply 18 000 ankle supports to Division B at any price lower than 30 percent below market price. All profits in Distantland are subject to taxation at a rate of 20 percent. Division A pays tax in Nearland at a rate of 40 percent on all profit.

Advise the management of SSA Group whether the management of Division B should be directed to purchase the ankle supports from Division A or to purchase a similar product from a local supplier in Distantland. Supporting calculations should be provided.

Step by Step Answer: