The August 31 bank statement of Ward's Supercenter has just arrived from United Bank. To prepare the

Question:

The August 31 bank statement of Ward's Supercenter has just arrived from United Bank. To prepare the Ward's bank reconciliation, you gather the following data:

a. Ward's Cash account shows a balance of \(\$ 2,420\) on August 31 .

b. The bank statement includes two NSF checks from customers: \(\$ 395\) and \(\$ 147\).

c. Ward's pays rent expense ( \(\$ 750\) ) and insurance expense ( \(\$ 290\) ) each month by EFT.

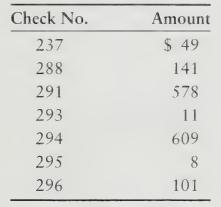

d. The Ward checks below are outstanding at August 31.

e. The bank statement includes a deposit of \(\$ 1,200\), collected on our note receivable by the bank.

f. The bank statement shows that Ward earned S18 of interest on its bank balance during August.

g. The bank statement lists a \(\$ 10\) bank service charge.

h. On August 31, Ward deposited \$316, but this deposit does not appear on the bank statement.

i. The bank statement includes a \(\$ 300\) deposit that Ward did not make. The bank erroneously credited Ward's account for another customer's deposit.

j. The August 31 bank balance is \(\$ 3,527\).

Requirements

1. Prepare the bank reconciliation for Ward's Supercenter at August 31.

2. Record the journal entries that bring the book balance of Cash into agreement with the adjusted book balance on the reconciliation. Include an explanation for each entry.

Step by Step Answer: