Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over

Question:

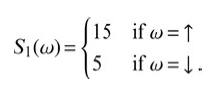

Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over one period of time is r = 25% and the initial value of the stock is S0 = $10. There are two possible states of the world at t = 1, say ?up? and ?down,? and the stock takes values

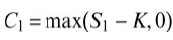

Now a call option on the stock is introduced into the market. Its payoff function is

with exercise price K = $13. Compute the risk neutral probabilities and the fair price C0 of the derivative contract.

(15 if w=1 S1(w) = 15 if w = Į. |C = max(Sj – K,0)

Step by Step Answer:

The risk neutral probabilities can be calculated as pup r dd...View the full answer

Related Video

A call option is a type of financial contract that gives the holder the right, but not the obligation, to buy an underlying asset (such as a stock, commodity, or currency) at a specified price (called the strike price) within a specified period of time. When an investor purchases a call option, they are essentially betting that the price of the underlying asset will rise above the strike price before the option\'s expiration date. If the price of the asset does rise above the strike price, the investor can exercise the option by buying the asset at the strike price and then selling it at the higher market price, thereby earning a profit. Call options are often used as a speculative investment strategy, as they allow investors to potentially profit from the upward movement of an asset without having to actually own the asset itself. They are also commonly used as a hedging tool to protect against potential losses in a portfolio.

Students also viewed these Business questions

-

A one-year long forward contract on a non-dividend-paying stock is entered into when the stock price is $40 and the risk-free rate of interest is 10% per annum with continuous compounding. a) What...

-

A company has assets with a market value of $100. It has one outstanding bond issue, a zero coupon bond maturing in two years with a face value of $75. The risk-free rate is 5 percent. The volatility...

-

The market value of Fords' equity, preferred stock and debt are $7 billion, $3 billion, and $10 billion, respectively. Ford has a beta of 1.8, the market risk premium is 7%, and the risk-free rate of...

-

How can adults continue to function relatively normally after surgery to remove the thymus, tonsils, spleen, or lymph nodes?

-

Write an equation for the reaction of bromine at room temperature with a. Propene b. 4-methylcyclohexene

-

Suppose you want to buy a stock with a 5 0 % initial and 3 0 % maintenance margin. The stock is worth $ 1 0 0 . a . What is the equity in your initial position? What is your leverage? b . Suppose the...

-

The stockholders' equity of Peak Corporation at January 1 follows: The following transactions, among others, occurred during the year: Jan. 12 Announced a 4-for-1 common stock split, reducing the par...

-

Develop a vendor-rating form that represents your comparison of the education offered by universities in which you considered (or are considering) enrolling. Fill in the necessary data, and identify...

-

What are the five TQM tools and techniques (in addition to benchmarking)? Briefly explain those. Tools and techniques Explanation 1 2 3 4 5

-

A block on a frictionless table is connected as shown in FIGURE P15.75 to two springs having spring constants k 1 and k 2 . Find an expression for the blocks oscillation frequency f in terms of the...

-

Consider the payoff matrix Check if the financial market is complete, and whether or not any cyclical permutation of the security price form results in an arbitrage free market. (1 2 D= 3 (s] = (1 2...

-

Convince yourself that the set K in Figure 5.2 left is not convex. Figure 5.2. K M

-

For signals with infinite support, their Fourier transforms cannot be derived from the Laplace transform unless they are absolutely integrable or the region of convergence of the Laplace transform...

-

Clay Incorporated has two divisions, Myrtle and Laurel. The following is the segmented income statement for the previous year: Myrtle Laurel Total Sales revenue $ 563,000 $ 336,500 $ 899,500 Variable...

-

The country's inflation rate is expected to reach an all-time high of 8% this year. What monetary policy should the Bangko Sentral ng Pilipinas implement to mitigate the situation? Concretize your...

-

12) Given tan = x/L, sin 0 = ma m/d , = 532 nm, m = = 3, L = 0.9 m, x = 3.2cm find d in mm:

-

Bob bought a new car for $29,000 with a loan that will be amortized over five years. The best interest rate he got from his bank for the loan was 2.19% percent compounded annually. What is Bob's...

-

For students to be aware of where they report cases of child abuse and neglect and what their responsibilities are as a mandated reporter. Provide all contact information (organization title,...

-

In 2013, you gave a $14,000 cash gift to your best friend. What is the gift tax?

-

"Standard-cost procedures are particularly applicable to process-costing situations." Do you agree? Why?

-

Sam and Taylor, residents of New Jersey, entered in to a domestic partnership in New Jersey in October 2004. However, they never obtained a marriage license. Sam died in March 2018, survived by...

-

George Tanner died October 2, 2017, survived by his son Thomas and his daughter Gigi Tanner Stewart and her children, Sam and Cindy. George was the sole stockholder of Tanner, Inc., a C corporation....

-

Your firm has prepared the estate tax return (Form 706) for the Estate of Belinda Baker, a widow who died January 13, 2018. Besides substantial amounts of cash, mostly in certificates of deposit, she...

-

1 ) Salem Co . has a year - end of December 3 1 and they are evaluating the cash flows of some potential investments / projects they are considering for their next fiscal year, starting January 1 ....

-

Find the amount accumulated FV in the given annuity account. ( Assume end - of - period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent. ) $ 2 , 6 0...

-

Which project phase includes creative thinking to identify any broad potential risks and their likelihood? A Closeout B Execution ( C ) Planning D ) Initiation

Study smarter with the SolutionInn App