The reload provision in an employee stock option entitles its holder to receive X/S units of

Question:

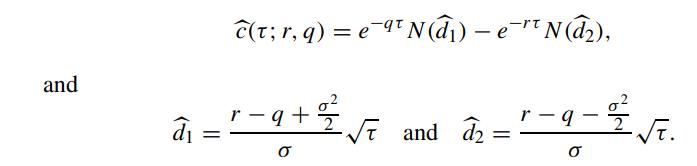

The reload provision in an employee stock option entitles its holder to receive X/S∗ units of newly “reloaded” at-the-money options from the employer upon exercise of the stock option. Here, X is the original strike price and S∗ is the prevailing stock price at the exercise moment. The “reloaded” option has the same date of expiration as the original option. The exercise payoff is given by S∗ − X + X/S c(S∗,τ ; S∗,r,q). By the linear homogeneity property of the call price function, we can express the exercise payoff as S−X+Sĉ(τ ;r,q), where

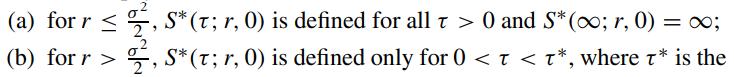

Let S∗(τ ;r,q) denote the optimal exercise boundary that separates the stopping and continuation regions. The stopping region and the optimal exercise boundary S∗(τ) observe the following properties (Dai and Kwok, 2008).

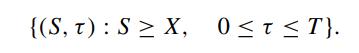

1. The stopping region is contained inside the region defined by

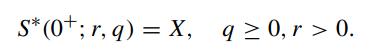

2. At a time close to expiry, the optimal stock price is given by

2. At a time close to expiry, the optimal stock price is given by

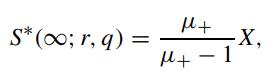

3. When the stock pays dividend at constant yield q > 0, the optimal stock price at infinite time to expiry is given by

3. When the stock pays dividend at constant yield q > 0, the optimal stock price at infinite time to expiry is given by

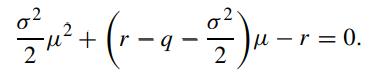

where μ+ is the positive root of the equation:

4. If the stock pays no dividend, then

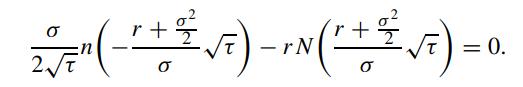

unique solution to the algebraic equation

Step by Step Answer: