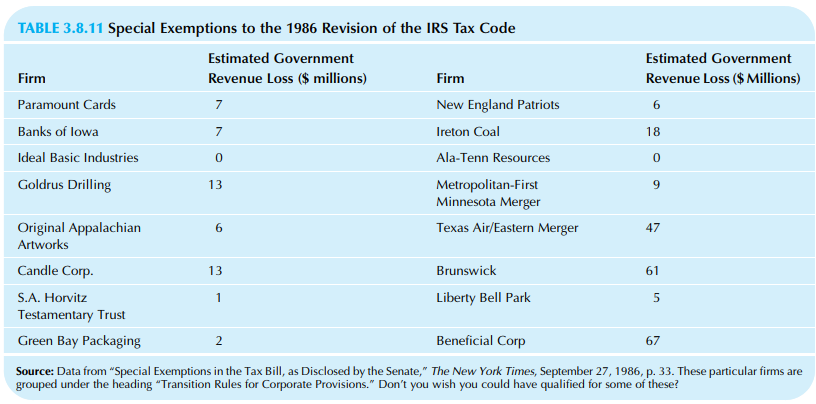

When the Internal Revenue Service (IRS) tax code was revised in 1986, Congress granted some special exemptions

Question:

When the Internal Revenue Service (IRS) tax code was revised in 1986, Congress granted some special exemptions to specific corporations. The U.S. government’s revenue losses due to some of these special transition rules for corporate provisions are shown in Table 3.8.11.

a. Construct a histogram for this data set.

b. Describe the distribution shape.

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: