Portfolio return and standard deviation David Choo is thinking of building an investment portfolio containing two stocksH

Question:

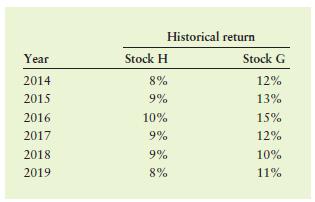

Portfolio return and standard deviation David Choo is thinking of building an investment portfolio containing two stocks—H and G. He has assigned 40% of his portfolio to stock H and the remaining 60% to stock G. David has decided to analyze some historical returns to get a sense for his portfolio’s possible future risk and return. Six years of historical annual returns for each stock are shown in the following table.

a. Calculate the actual portfolio return, rp, for each of the six years assuming the portfolio weights remain same.

b. Calculate the average return for each stock and the portfolio over the six-year period.

c. Calculate the standard deviation of annual returns for each stock and the portfolio.

How does the portfolio standard deviation compare to the standard deviation of the individual stocks?

d. Calculate the correlation coefficient for the two stocks. How would you characterize the correlation of returns of the two stocks?

e. Discuss any likely benefits of diversification achieved by David through creation of the portfolio.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart