Answered step by step

Verified Expert Solution

Question

1 Approved Answer

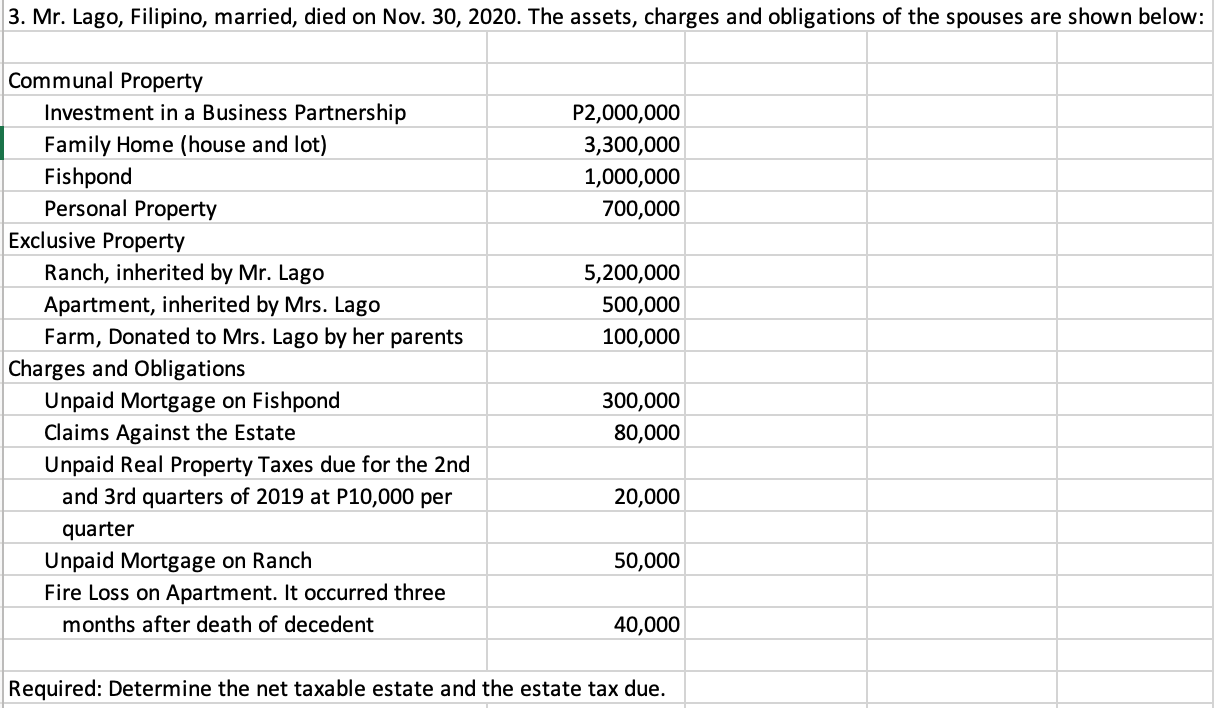

3. Mr. Lago, Filipino, married, died on Nov. 30, 2020. The assets, charges and obligations of the spouses are shown below: Communal Property Investment

3. Mr. Lago, Filipino, married, died on Nov. 30, 2020. The assets, charges and obligations of the spouses are shown below: Communal Property Investment in a Business Partnership Family Home (house and lot) Fishpond Personal Property Exclusive Property Ranch, inherited by Mr. Lago Apartment, inherited by Mrs. Lago Farm, Donated to Mrs. Lago by her parents Charges and Obligations Unpaid Mortgage on Fishpond Claims Against the Estate Unpaid Real Property Taxes due for the 2nd and 3rd quarters of 2019 at P10,000 per quarter Unpaid Mortgage on Ranch Fire Loss on Apartment. It occurred three months after death of decedent P2,000,000 3,300,000 1,000,000 700,000 5,200,000 500,000 100,000 300,000 80,000 20,000 50,000 40,000 Required: Determine the net taxable estate and the estate tax due.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the net taxable estate and the estate tax due we need to calculate the total value of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started