Answered step by step

Verified Expert Solution

Question

1 Approved Answer

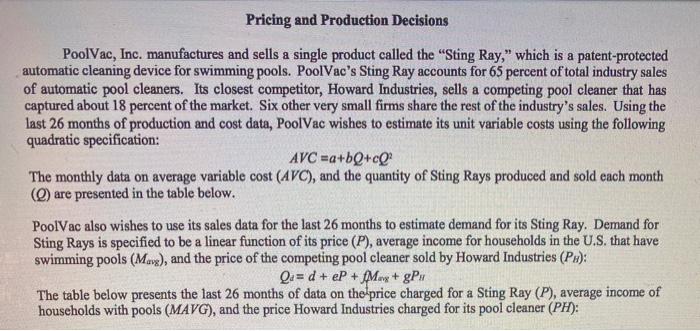

Pricing and Production Decisions PoolVac, Inc. manufactures and sells a single product called the Sting Ray, which is a patent-protected automatic cleaning device for

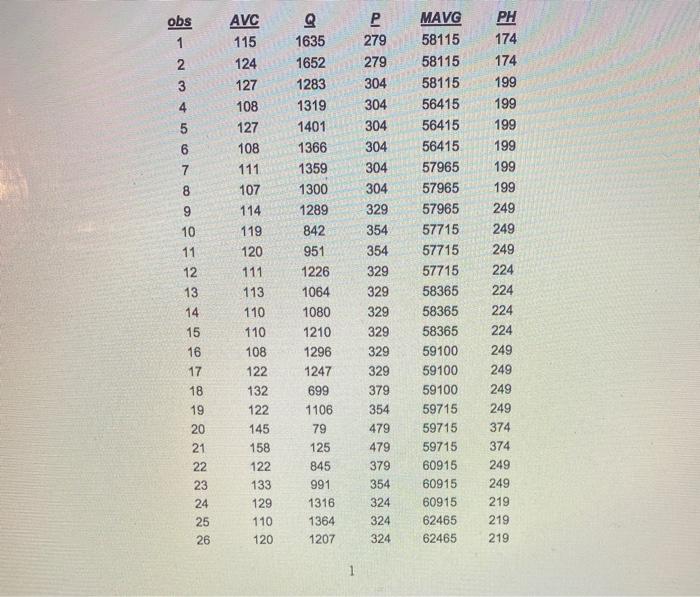

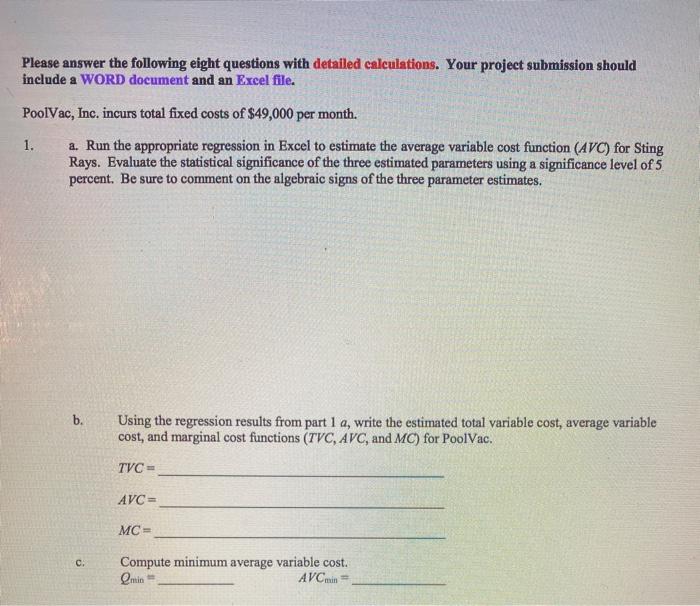

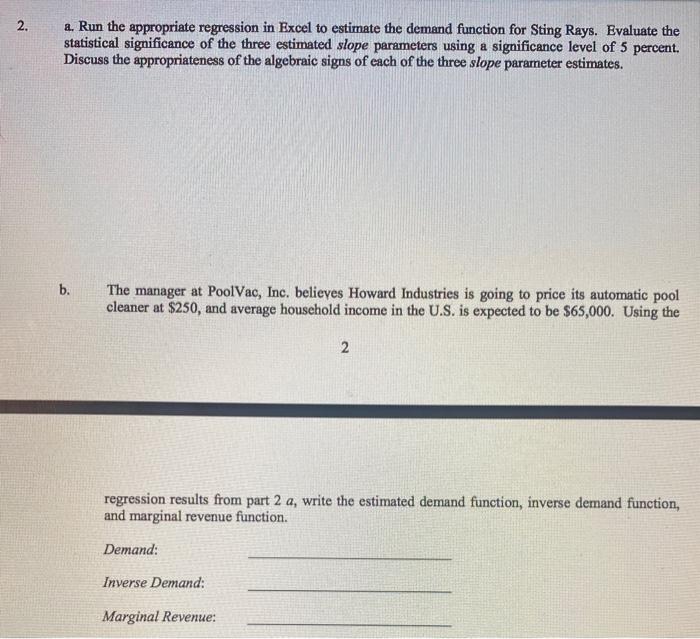

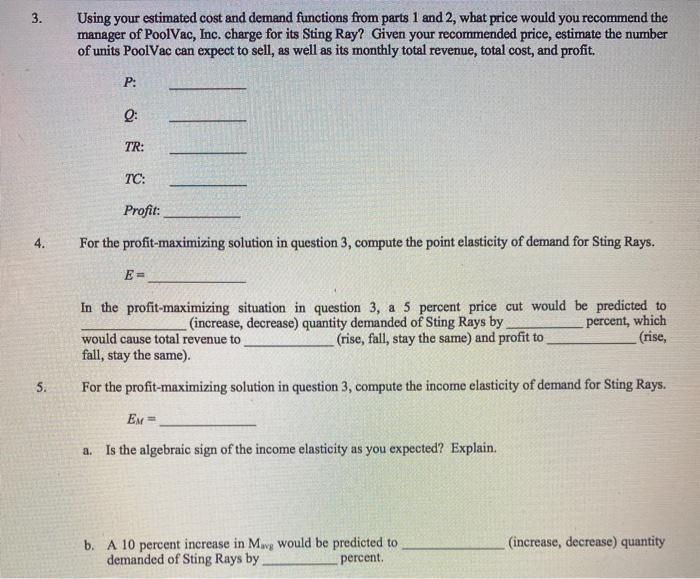

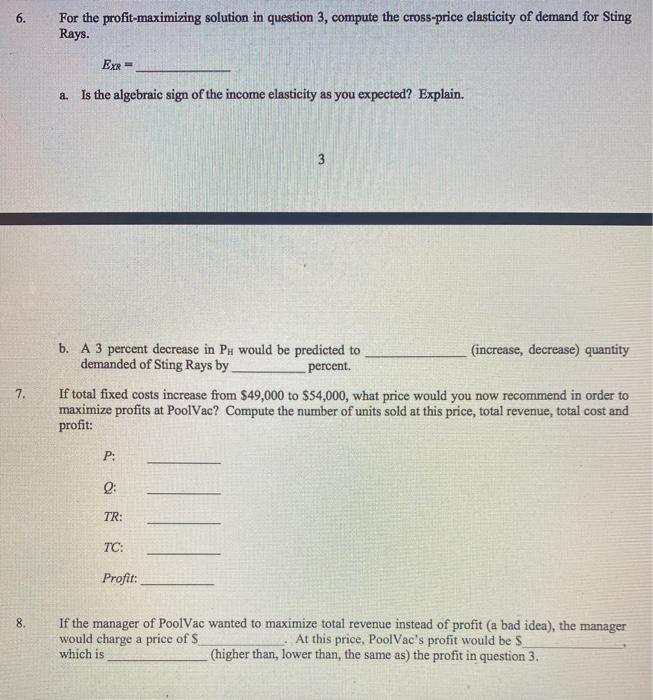

Pricing and Production Decisions PoolVac, Inc. manufactures and sells a single product called the "Sting Ray," which is a patent-protected automatic cleaning device for swimming pools. PoolVac's Sting Ray accounts for 65 percent of total industry sales of automatic pool cleaners. Its closest competitor, Howard Industries, sells a competing pool cleaner that has captured about 18 percent of the market. Six other very small firms share the rest of the industry's sales. Using the last 26 months of production and cost data, PoolVac wishes to estimate its unit variable costs using the following quadratic specification: AVC=a+bQ+cQ The monthly data on average variable cost (AVC), and the quantity of Sting Rays produced and sold each month (2) are presented in the table below. PoolVac also wishes to use its sales data for the last 26 months to estimate demand for its Sting Ray. Demand for Sting Rays is specified to be a linear function of its price (P), average income for households in the U.S. that have swimming pools (Mag), and the price of the competing pool cleaner sold by Howard Industries (PH): Qa= d+ eP+M+ gPl The table below presents the last 26 months of data on the price charged for a Sting Ray (P), average income of households with pools (MAVG), and the price Howard Industries charged for its pool cleaner (PH): obs 1 2 3 4 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22222 23 24 25 26 AVC 115 124 127 108 127 108 111 107 114 119 120 111 113 110 110 108 122 132 122 145 158 122 133 129 110 120 G 1635 1652 1283 1319 1401 1366 1359 1300 1289 842 951 1226 1064 1080 1210 1296 1247 699 1106 79 125 845 991 1316 1364 1207 1 P 279 279 304 304 304 304 304 304 329 354 354 329 329 329 329 329 329 379 354 479 479 379 354 324 324 324 MAVG 58115 PH 174 58115 174 58115 199 56415 199 56415 199 56415 199 57965 199 57965 199 57965 249 57715 249 57715 249 57715 224 58365 224 58365 224 58365 224 59100 249 59100 249 59100 249 59715 249 59715 374 59715 374 60915 249 60915 249 60915 219 62465 219 62465 219 Please answer the following eight questions with detailed calculations. Your project submission should include a WORD document and an Excel file. PoolVac, Inc. incurs total fixed costs of $49,000 per month. a. Run the appropriate regression in Excel to estimate the average variable cost function (AVC) for Sting Rays. Evaluate the statistical significance of the three estimated parameters using a significance level of 5 percent. Be sure to comment on the algebraic signs of the three parameter estimates. 1. b. C. Using the regression results from part 1 a, write the estimated total variable cost, average variable cost, and marginal cost functions (TVC, AVC, and MC) for PoolVac. TVC == AVC= MC= Compute minimum average variable cost. emin AVC min 2. a. Run the appropriate regression in Excel to estimate the demand function for Sting Rays. Evaluate the statistical significance of the three estimated slope parameters using a significance level of 5 percent. Discuss the appropriateness of the algebraic signs of each of the three slope parameter estimates. b. The manager at PoolVac, Inc. believes Howard Industries is going to price its automatic pool cleaner at $250, and average household income in the U.S. is expected to be $65,000. Using the regression results from part 2 a, write the estimated demand function, inverse demand function, and marginal revenue function. Demand: Inverse Demand: 2 Marginal Revenue: 3. 4. 5. Using your estimated cost and demand functions from parts 1 and 2, what price would you recommend the manager of PoolVac, Inc. charge for its Sting Ray? Given your recommended price, estimate the number of units PoolVac can expect to sell, as well as its monthly total revenue, total cost, and profit. P: Q: TR: TC: Profit: For the profit-maximizing solution in question 3, compute the point elasticity of demand for Sting Rays. E= In the profit-maximizing situation in question 3, a 5 percent price cut would be predicted to (increase, decrease) quantity demanded of Sting Rays by (rise, fall, stay the same) and profit to percent, which (rise, would cause total revenue to fall, stay the same). For the profit-maximizing solution in question 3, compute the income elasticity of demand for Sting Rays. EM= a. Is the algebraic sign of the income elasticity as you expected? Explain. b. A 10 percent increase in Mag would be predicted to demanded of Sting Rays by percent. (increase, decrease) quantity 6. 7. 8. For the profit-maximizing solution in question 3, compute the cross-price elasticity of demand for Sting Rays. EXR= a. Is the algebraic sign of the income elasticity as you expected? Explain. b. A 3 percent decrease in PH would be predicted to demanded of Sting Rays by percent. P: If total fixed costs increase from $49,000 to $54,000, what price would you now recommend in order to maximize profits at PoolVac? Compute the number of units sold at this price, total revenue, total cost and profit: Q: TR: 3 TC: Profit: (increase, decrease) quantity If the manager of PoolVac wanted to maximize total revenue instead of profit (a bad idea), the manager would charge a price of S At this price, Pool Vac's profit would be S which is (higher than, lower than, the same as) the profit in question 3.

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

DETAILED RESPONSE Here is a detailed response to your questions 1 a Running the regression in Excel to estimate the average variable cost function AVC for Sting Rays we get the following results AVC 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started