Question

The Financial officer at RGIT wants you to develop an application that will evaluate the company?s asset?s annual depreciation using the double-declining balance and sum-of-the

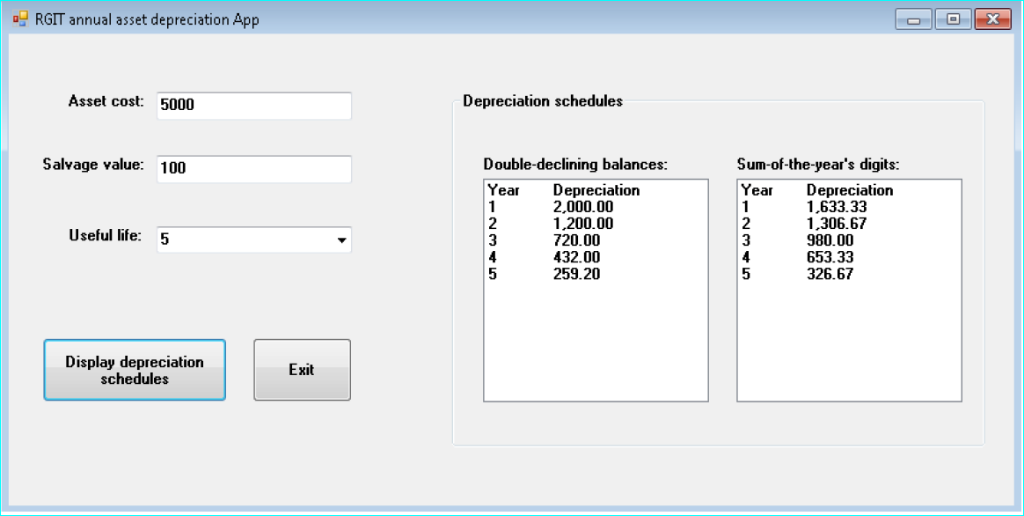

The Financial officer at RGIT wants you to develop an application that will evaluate the company?s asset?s annual depreciation using the double-declining balance and sum-of-the years? digit method. The Financial officer will enter the asset?s cost, useful life (in years), and salvage value (which is the value of the asset at the end of its useful life). The sample of the application can be seen in Figure 2. The interface provides text boxes for entering the asset cost and salvage value. It also provides a list box for selecting the useful life, which ranges from 3 to 20 years. The depreciation amounts are displayed in the list boxes. (You can use the DDB and SYD functions in Microsoft Excel to verify the amounts shown in Figure 2 are correct). Create a windows form application using the name RGIT annual asset depreciation App. You can use the visual basic?sFinancial.DDB method to calculate the double-declining balance depreciation and use its Financial.SYD method to calculate the sum-of-the-years? digit depreciation. The Financial.DDB method syntax is Financial.DDB (cost, salvage, life, period). The Financial.SYD method syntax is Financial.SYD (cost, salvage, life, period). In both syntaxes, the cost, salvage and life argumentsare the asset?s cost, salvage value and useful life respectively. The period argument is the period for which you want the depreciation amount calculated. Both methods return the depreciation amount as double number. Code the application, save the solution and run the application

RGIT annual asset depreciation App Asset cost: 5000 Salvage value: 100 Useful life: 5 Display depreciation schedules Exit Depreciation schedules Double-declining balances: Year 1 2 3 5 Depreciation 2,000.00 1,200.00 720.00 432.00 259.20 Sum-of-the-year's digits: Depreciation 1,633.33 1,306.67 980.00 Year 1 2 3 4 5 653.33 326.67

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

After the designing part gets completed just double click the Display Depreciation Schedules button ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started