On March 19, 2003, the SEC filed accounting fraud charges in the Northern District of Alabama against

Question:

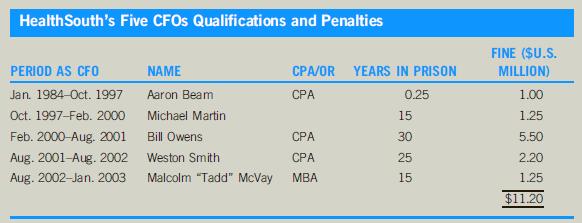

On March 19, 2003, the SEC filed accounting fraud charges in the Northern District of Alabama against HealthSouth Corporation and its CEO, Richard Scrushy. Scrushy was also charged with knowingly miscertifying the accuracy and completeness of the company’s financial statements. Consequently, Scrushy became the first CEO to be charged under the governancereforming SOX. Although five HealthSouth CFOs testified that Scrushy had knowingly directed the fraud, on June 28, 2005, the Alabama jury acquitted him of all thirtysix criminal charges, and later some civil charges were initially dismissed. In contrast, the five CFOs were initially sentenced to receive a total of 115 years in prison and

\($11.2\) million in fines. One of the CFOs, Weston Smith, had become a whistleblower who had launched a qui tam1 lawsuit under the False Claims Act against HealthSouth and first told prosecutors about the financial statement falsification process. He was sentenced to twenty-five years and a \($2.2\) million fine. How did all this happen?

According to the SEC complaint,2 HealthSouth was founded in 1984 and grew to become the largest provider of outpatient surgery, diagnostic, and rehabilitative health care services in the United States. By 2003, it owned or operated over 1,800 different facilities with worldwide revenues and earnings of \($4\) billion and

\($76\) million, respectively, in 2001. Health-

South’s stock was listed on the New York Stock Exchange (NYSE), trading under the symbol HRC. Scrushy, who founded HRC, served as its chairman and CEO from 1994 to 2002. He relinquished the CEO title on August 27, 2002, but reassumed it on January 6, 2003.

The SEC claim states that Scrushy instructed that HRC earnings be inflated as early as just after the company’s stock was listed on the NYSE in 1986. Specifically, during the forty-two-month period between 1999 and the six months ended on June 30, 2002, HRC’s income (loss)

before income taxes and minority interests was inflated by at least \($1.4\) billion.

Each quarter, HRC’s senior officers would meet with Scrushy and compare HRC’s actual results with those expected by Wall Street analysts. If there was a shortfall,

“Scrushy would tell HRC’s management to

‘fix it’ by recording false entries on HRC’s accounting records.”3 HRC’s senior accounting personnel then convened a meeting—

referred to as “family meetings”—to “fix”

the earnings. How this was done and how the auditors were deceived is outlined in the SEC complaint as follows:

At these meetings, HRC’s senior accounting personnel discussed what false entries could be made and recorded to inflate reported earnings to match Wall Street analyst’s expectations.

These entries primarily consisted of reducing a contra revenue account, called “contractual adjustment,”

and/or decreasing expenses,

(either of which increased earnings), and correspondingly increasing assets or decreasing liabilities........

Questions:-

1. What were the major flaws in Health-

South’s governance?

2. What should HealthSouth’s auditors, Ernst & Young, have done if they had perceived these flaws?

3. How—in accounting terms—did the manipulation of HealthSouth’s financial statements take place?

4. Why did all the people who knew about the manipulation keep quiet?

5. What is the auditor’s responsibility in a case of fraud?

6. What are the proper audit procedures to ensure existence of assets in the financial statements? What are the proper audit procedures to validate estimates?

7. What areas of risk can you identify in HealthSouth’s control environment before 2003?

8. What areas of risk can you identify in HealthSouth’s strategy before 2002?

9. What changes could be made in HealthSouth’s control system and corporate governance structure to mitigate the risk of accounting fraud in future years?

10. Was Scrushy’s defense ethical?

Step by Step Answer:

Business And Professional Ethics

ISBN: 9781337514460

8th Edition

Authors: Leonard J Brooks, Paul Dunn