Tsoulos, Tsoulakis and Associates is a small firm of architectural consultants. At 1 July 2018, three architects

Question:

Tsoulos, Tsoulakis and Associates is a small firm of architectural consultants. At 1 July 2018, three architects other than the principals, Tony Tsoulos and Maria Tsoulakis, are employed. The following information is relevant for the 2018–2019 financial year.

It is expected that each of the five architects in the firm will work an average of 46 weeks, working a 40-hour week. All hours worked on client jobs are charged at a charge-out rate determined for each architect. Only 70% of the total hours worked by the principals and 85% of the total hours worked by others are assigned directly to client jobs.

The total labour costs of all five architects for the year ended 30 June 2019 are $530 000

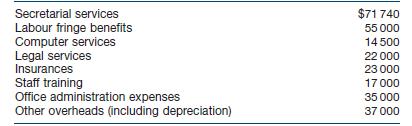

(Tsoulos and Tsoulakis $300 000, other architects $230 000). Expected overheads of the firm for the year (except for the labour costs of architects not directly charged to clients) are:

During the year, the firm completed a consultancy for one of its regular clients, Superior Homes Ltd. Tony Tsoulos and one other architect, Tung Thanh Tran, worked on this particular job. Tony charges his time to clients at $100 per hour. Tung Thanh’s gross salary and other costs amount to $93 840. Tony worked on the job for 20 hours and payroll time sheets showed that Tung Thanh had spent 60 hours on the job.

Required

(a) Determine the costs to be charged to Superior Homes Ltd for labour and overheads.

(b) If the firm has a mark-up of 25% on total costs charged to a job in determining gross fees, what was the total professional fee (ignore GST) shown on the tax invoice sent to Superior Homes Ltd?

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie