Start with the partial model in the file Ch16 P18 Build a Model.xlsx on the textbook?s Web

Question:

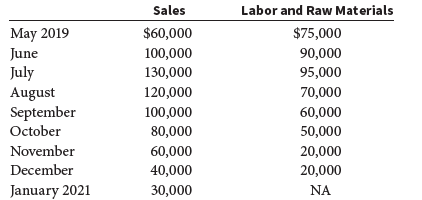

Start with the partial model in the file Ch16 P18 Build a Model.xlsx on the textbook?s Web site. Rusty Spears, CEO of Rusty?s Renovations, a custom building and repair company, is preparing documentation for a line of credit request from his commercial banker. Among the required documents is a detailed sales forecast for parts of 2020 and 2021:

Estimates obtained from the credit and collection department are as follows: collections within the month of sale, 15%; collections during the month following the sale, 65%; collections the second month following the sale, 20%. Payments for labor and raw materials are typically made during the month following the one in which these costs were incurred. Total costs for labor and raw materials are estimated for each month as shown in the table.

General and administrative salaries will amount to approximately $15,000 a month; lease payments under long-term lease contracts will be $5,000 a month; depreciation charges will be $7,500 a month; miscellaneous expenses will be $2,000 a month; income tax payments of $25,000 will be due in both September and December; and a progress payment of $80,000 on a new office suite must be paid in October. Cash on hand on July 1 will amount to $60,000, and a minimum cash balance of $40,000 will be maintained throughout the cash budget period.

a. Prepare a monthly cash budget for the last 6 months of 2020.

b. Prepare an estimate of the required financing (or excess funds)?that is, the amount of money Rusty?s Renovations will need to borrow (or will have available to invest)? for each month during that period.

c. Assume that receipts from sales come in uniformly during the month (i.e., cash receipts come in at the rate of 1/30 each day) but that all outflows are paid on the 5th of the month. Will this have an effect on the cash budget?in other words, would the cash budget you have prepared be valid under these assumptions? If not, what can be done to make a valid estimate of peak financing requirements? No calculations are required, although calculations can be used to illustrate the effects.

d. Rusty?s Renovations produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the company?s current ratio and debt ratio would vary during the year assuming all financial requirements were met by short-term bank loans. Could changes in these ratios affect the firm?s ability to obtain bank credit? Why or why not?

e. If its customers began to pay late, this would slow down collections and thus increase the required loan amount. Also, if sales dropped off, this would have an effect on the required loan amount. Perform a sensitivity analysis that shows the effects of these two factors on the maximum loan requirement.

Cash BudgetA cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Corporate Finance A Focused Approach

ISBN: 978-1337909747

7th edition

Authors: Michael C. Ehrhardt, Eugene F. Brigham