Suppose the rates of return of the bond portfolio in the four scenarios of Spreadsheet 6.1 are

Question:

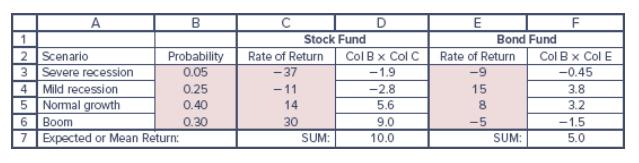

Suppose the rates of return of the bond portfolio in the four scenarios of Spreadsheet 6.1 are −10% in a severe recession, 10% in a mild recession, 7% in a normal period, and 2% in a boom. The stock returns in the four scenarios are −37%, −11%, 14%, and 30%. What are the covariance and correlation coefficient between the rates of return on the two portfolios?

Spreadsheet 6.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

ISE Essentials Of Investments

ISBN: 9781265450090

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus

Question Posted: