Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the

Question:

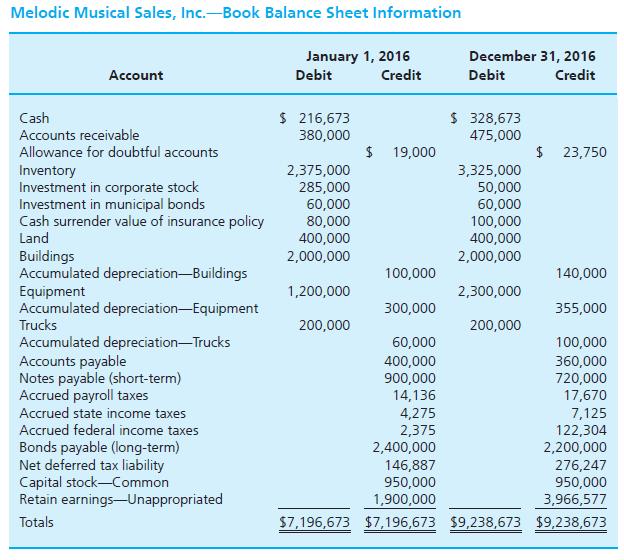

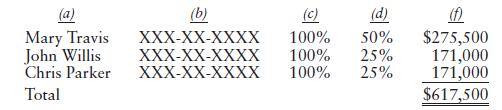

Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the calendar year and accrual basis for both book and tax purposes. It is engaged in the sale of musical instruments with an employer identification number (EIN) of XX-2018016. The company incorporated on December 31, 2012, and began business on January 2, 2013. Table C:3-4 contains balance sheet information at January 1, 2016, and December 31, 2016. Table C:3-5 presents an unaudited GAAP income statement for 2016. These schedules are presented on a book basis. Other information follows the tables. Estimated Tax Payments (Form 2220):

The corporation deposited estimated tax payments as follows:

Table C:3-4

Taxable income in 2015 was $1.6 million, and the 2015 tax was $544,000. The corporation earned its 2016 taxable income evenly throughout the year. Therefore, it does not use the annualization or seasonal methods.

Inventory and Cost of Goods Sold (Form 1125-A):

The corporation uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market. Only beginning inventory, ending inventory, and purchases should be reflected on Form 1125-A. No other costs or expenses are allocated to cost of goods sold. Note: the corporation is exempt from the uniform capitalization (UNICAP) rules because average gross income for the previous three years was less than $10 million.

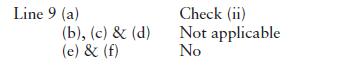

Compensation of Officers (Form 1125-E):

Bad Debts:

For tax purposes, the corporation uses the direct writeoff method of deducting bad debts. For book purposes, the corporation uses an allowance for doubtful accounts. During 2016, the corporation charged $38,000 to the allowance account, such amount representing actual writeoffs for 2016.

Table C:3-5

Additional Information (Schedule K):

1 b Accrual

2 a 451140

b Retail sales

c Musical instruments

3 No

4 a No

b Yes; omit Schedule G

5 a No

b No

6-7 No

8 Do not check box

9 Fill in the correct amount

10 3

11 Do not check box

12 Not applicable

13-14 No

15a No

b Do not check box

16-19 No

Organizational Expenditures:

The corporation incurred less than $5,000 of organizational expenditures in the year it began business. For book purposes, the corporation expensed the entire expenditure. For tax purposes, the corporation elected under Sec. 248 to deduct the entire amount of expenditures in the year it began business. Therefore, no amortization expenditures appear in the tax return or book financial statements for the current year.

Capital Gains and Losses:

The corporation sold 100 shares of PDQ Corp. common stock on October 7, 2016, for $150,000. The corporation acquired the stock on December 15, 2015, for $100,000. The corporation also sold 75 shares of JSB Corp. common stock on June 17, 2016, for $120,000. The corporation acquired this stock on September 18, 2014, for $135,000. The corporation has a $20,000 capital loss carryover from 2015. These transactions were not reported to the corporation on Form 1099-B.

Fixed Assets and Depreciation:

For book purposes: The corporation uses straight-line depreciation over the useful lives of assets as follows: store building, 50 years; equipment, ten years; and trucks, five years. The corporation takes a half-year?s depreciation in the year of acquisition and the year of disposition and assumes no salvage value. The book financial statements in Tables C:3-4 and C:3-5 reflect these calculations.

For tax purposes: All assets are MACRS property as follows: store building, 39-year nonresidential real property; equipment, seven-year property; and trucks, five-year property. The corporation acquired the store building for $2 million and placed it in service on January 2, 2013. The corporation acquired two pieces of equipment for $400,000 (Equipment 1) and $800,000 (Equipment 2) and placed them in service on January 2, 2013. The corporation acquired the trucks for $200,000 and placed them in service on July 18, 2014. The trucks are not listed property and are not subject to the limitation on luxury automobiles. The corporation did not make the expensing election under Sec. 179 or take bonus depreciation on any property acquired before 2016. Accumulated tax depreciation through December 31, 2015, on these properties is as follows:

Store building .....................................$ 151,780

Equipment..................................... 225,080

Equipment ..................................... 450,160

Trucks .....................................104,000

On October 16, 2016, the corporation sold for $440,000 Equipment 1 that originally cost 400,000 on January 2, 2013. The corporation had no Sec. 1231 losses from prior years.?

In a separate transaction on October 17, 2016, the corporation acquired and placed in service a piece of equipment costing $1,500,000. Assume these two transactions do not qualify as a like-kind exchange. The new equipment is seven-year property. The corporation made the Sec. 179 expensing election with regard to the new equipment but elected out of bonus depreciation. Where applicable, use published IRS depreciation tables to compute 2016 depreciation (reproduced in Appendix C of this text).

Other Information:

The corporation?s activities do not qualify for the U.S. production activities deduction.?

Ignore the AMT and accumulated earnings tax.

The corporation received dividends (see Income Statement in Table C:3-5) from taxable, domestic corporations, the stock of which Melodic Musical Sales, Inc. owns less than 20%.

The corporation paid $95,000 in cash dividends to its shareholders during the year and charged the payment directly to retained earnings.

The state income tax in Table C:3-5 is the exact amount of such taxes incurred during the year.

The corporation has not entitled to any credits.

Ignore the financial statement impact of any underpayment penalties incurred on the tax return.

Required:

Prepare the 2016 corporate tax return for Melodic Musical Sales, Inc. along with any necessary supporting schedules.?

Prepare both Schedule M-3 (but omit Schedule B and Form 8916-A) and Schedule M-1 even though the IRS does not require both Schedule M-1 and Schedule M-3.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson