Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31

Question:

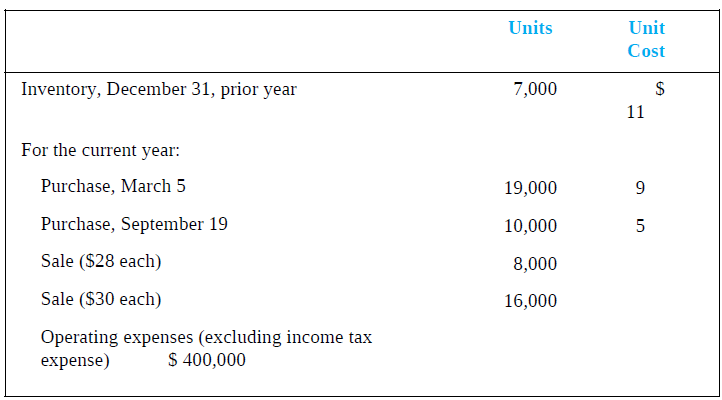

Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2:

Required:

1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. For each case, show the computation of the ending inventory and cost of goods sold. (Hint: Set up adjacent columns for each case.)

2. Compare the pretax income and the ending inventory amounts between the two cases. Explain the similarities and differences.

3. Which inventory costing method may be preferred for income tax purposes? Explain.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259964947

10th edition

Authors: Robert Libby, Patricia Libby, Frank Hodge