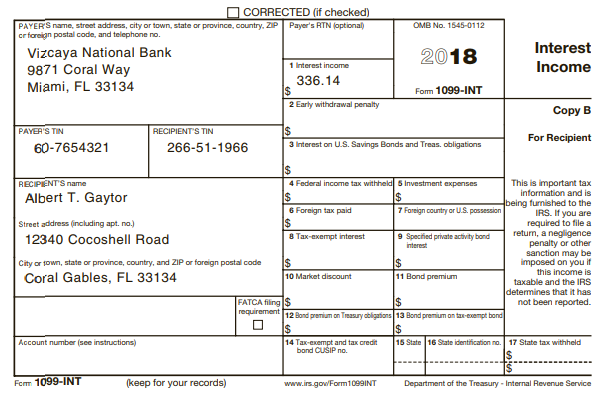

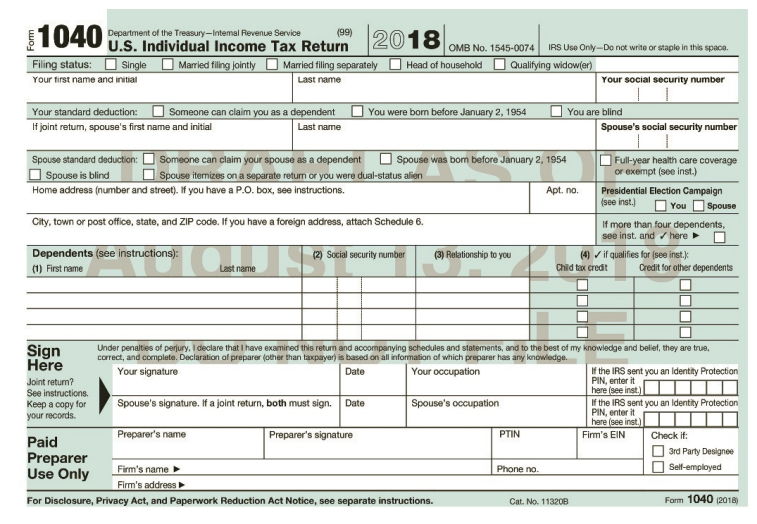

Albert Gaytor and his wife Allison are married and file a joint return for 2018. The Gaytors

Question:

Albert Gaytor and his wife Allison are married and file a joint return for 2018. The Gaytors live at 12340 Cocoshell Road, Coral Gables, FL 33134. Captain Gaytor is a charter fishing boat captain but took 6 months off from his job in 2018 to train and study for his Masters Captain?s License.?

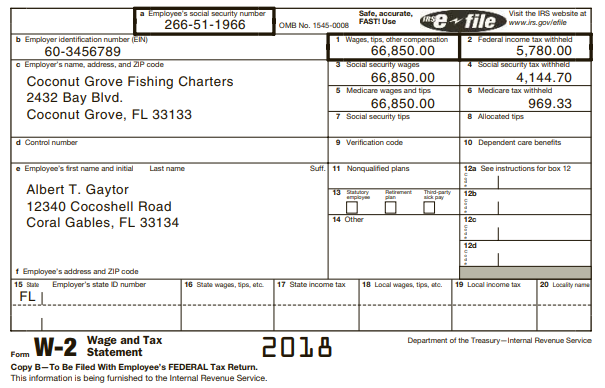

In 2018, Albert received a Form W-2 from his employer, Coconut Grove Fishing Charters, Inc.:?

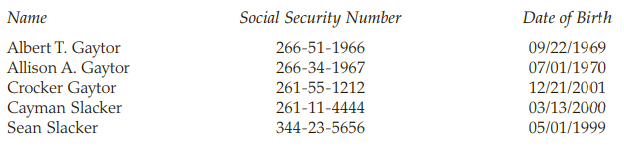

The Gaytors have a 17-year-old son, Crocker, who is a full-time freshman at Brickell State University. The Gaytors also have an 18-year-old daughter, Cayman, who is a part-time student at Dade County Community College (DCCC). Cayman is married to Sean Slacker, who is 19 years old and a part-time student at DCCC. Sean and Cayman have a 1-year-old child, Wanda Slacker (Social Security number 648-99-4306). Sean, Cayman, and Wanda all live in an apartment up the street from Albert and Allison during the entire current calendar year. Sean and Cayman both work for Sean?s wealthy grandfather as apprentices in his business. Their wages for the year were a combined $50,000, which allowed them to pay all the personal expenses for themselves and their daughter. Albert and Allison have a savings account and received the following Form 1099-INT for 2018:?

Required:?

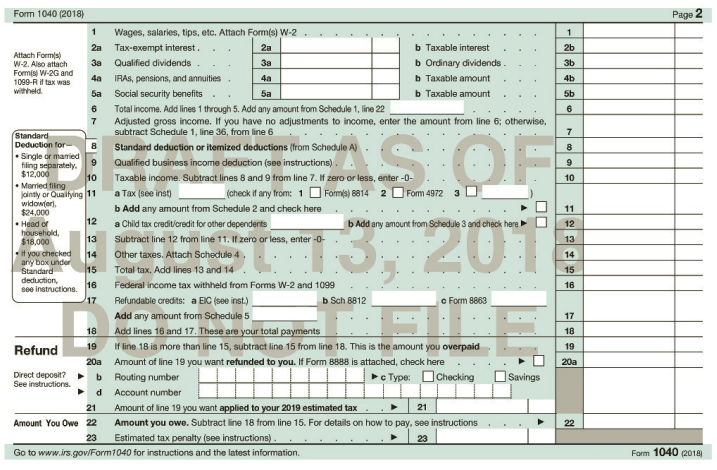

Use a computer software package such as Intuit Proconnect to complete Form 1040 for Albert and Allison Gaytor for 2018. Be sure to save your data input files since this case will be expanded with more tax information in later chapters. Make assumptions regarding any information not given.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill