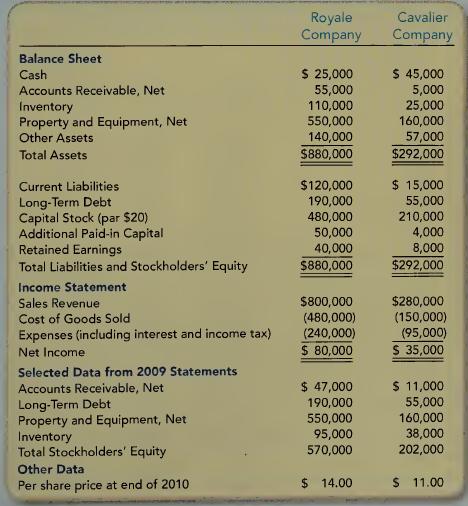

The 2010 financial statements for Royale and Cavalier companies are summarized here: These two companies are in

Question:

The 2010 financial statements for Royale and Cavalier companies are summarized here:

These two companies are in the same line of business and the same state but different cities. One-half of Royale’s sales and one-quarter of Cavalier’s sales are on credit. Each company has been in operation for about 10 years. Both companies received an unqualified audit opinion on the financial statements. Royale Company wants to borrow \($75,000\) cash, and Cavalier Company is asking for \($30,000.\) The loans will be for a two-year period. Both companies estimate bad debts based on an aging analysis, but Cavalier has estimated slightly higher uncollectible rates than Royale. Neither company issued stock in 2010.

Required:

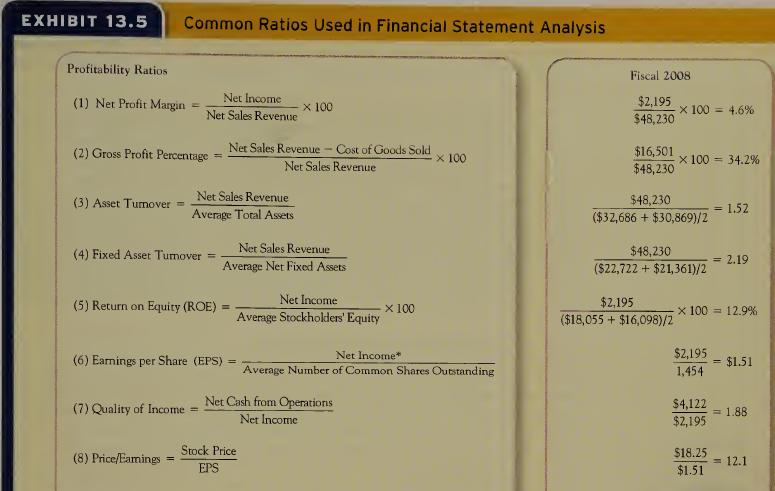

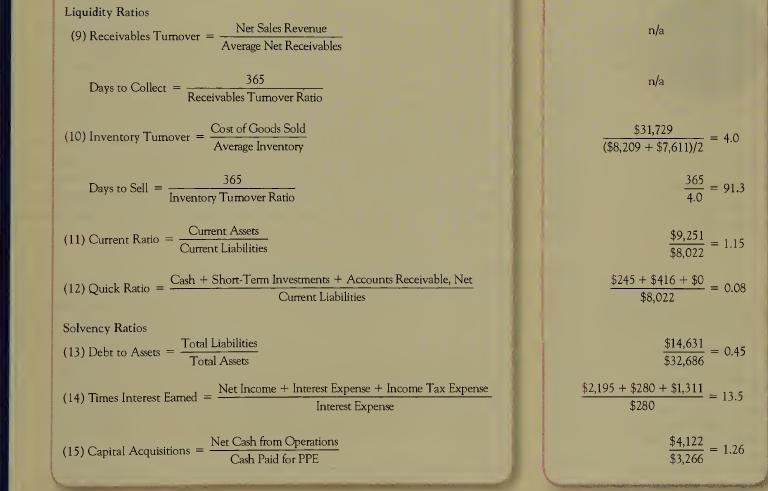

1. Calculate the ratios in Exhibit 13.5 for which sufficient information is available. Round all calculations to two decimal places.

2. Assume that you work in the loan department of a local bank. You have been asked to analyze the situation and recommend which loan is preferable. Based on the data given, your analysis prepared in requirement 1, and any other information, give your choice and the supporting explanation.

Step by Step Answer:

Managerial Accounting

ISBN: 9780078110771

1st Edition

Authors: Stacey WhitecottonRobert LibbyRobert Libby, Patricia LibbyRobert Libby, Fred Phillips