The following is partial information for Dupre Companys most recent year of operation. It manufactures pet toys

Question:

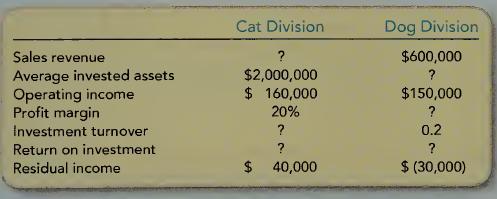

The following is partial information for Dupre Company’s most recent year of operation. It manufactures pet toys and categorizes its operations into two divisions, Cat and Dog.

Required:

1. Without making any calculations, determine whether each division’s return on investment is above or below Dupre’s hurdle rate. How can you tell?

2. Determine the missing amounts in the preceding table.

3. What is Dupre’s hurdle rate?

4. Suppose Dupre has the opportunity to invest additional assets to help expand the company’s market share. The expansion would require an average investment of \($2\) million and would generate \($140,000\) in additional income. From Dupre’s perspective, is this a viable investment? Why or why not?

5. Suppose the two divisions would equally share the investment and profits from the expansion project. If return on investment is used to evaluate performance, what will each division manager think about the proposed project?

6. In requirement 5, will either manager’s preference change if residual income is used to measure division performance? Explain your answer.

Step by Step Answer:

Managerial Accounting

ISBN: 9780078110771

1st Edition

Authors: Stacey WhitecottonRobert LibbyRobert Libby, Patricia LibbyRobert Libby, Fred Phillips